Investing.com’s stocks of the week

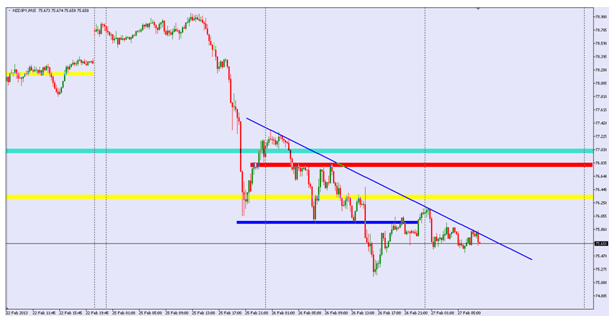

An interesting setup is apparent for NZD/JPY where the price was forming a descending triangle for the past two days (blue lines). Technically, if the formation is created after a downswing, it should suggest that this movement will be continued. Ben Bernanke helped bears with the breakout and the price managed to fall almost 70 pips. After that, bears lost their initiative and at the end of the American session, they allowed buyers to come back to the recent support being now the closest resistance.

NZD/JPY" title="NZD/JPY" width="615" height="322" />

NZD/JPY" title="NZD/JPY" width="615" height="322" />

The yellow line was the long-term support related to the levels from the end of January but as we can see traders did not pay any special attention to this area when forming a descending triangle.

The descending triangle support is no longer in use, but we can see that its resistance is now a short-term trendline. If bulls will manage to break it, we can expect an upswing aiming at least at 76.80 (red area). As long as the price stays below, we should be looking for good places to open short positions.

NZD/JPY" title="NZD/JPY" width="615" height="322" />

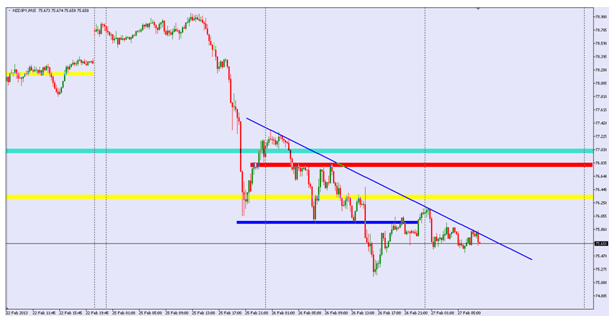

NZD/JPY" title="NZD/JPY" width="615" height="322" />The yellow line was the long-term support related to the levels from the end of January but as we can see traders did not pay any special attention to this area when forming a descending triangle.

The descending triangle support is no longer in use, but we can see that its resistance is now a short-term trendline. If bulls will manage to break it, we can expect an upswing aiming at least at 76.80 (red area). As long as the price stays below, we should be looking for good places to open short positions.