NZD/JPY

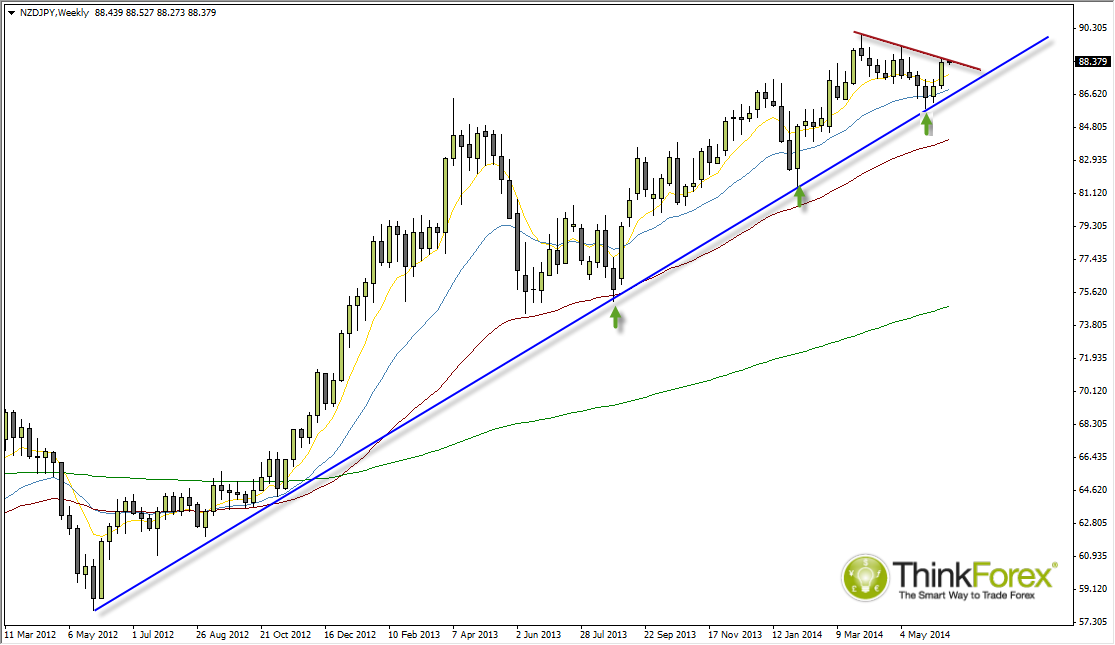

This pair dropped off of my wathclist as it grinded lower. However, as price is pausing just beneath a pivotal resistance area I suspect a bullish breakout is pending.

As always it is easier to see in hindsight, but the previous swing low was times too early and now satisfied the timing of the latest [suspect] swing low on W1 carries more merit. The Moving average remains in order and pointing up with the 8-week eMA beginning to curl upwards.

Additionally, the latest interest rate rises from RBNZ (with more to follow) should also continue to help this trend becomes established and break to new highs.

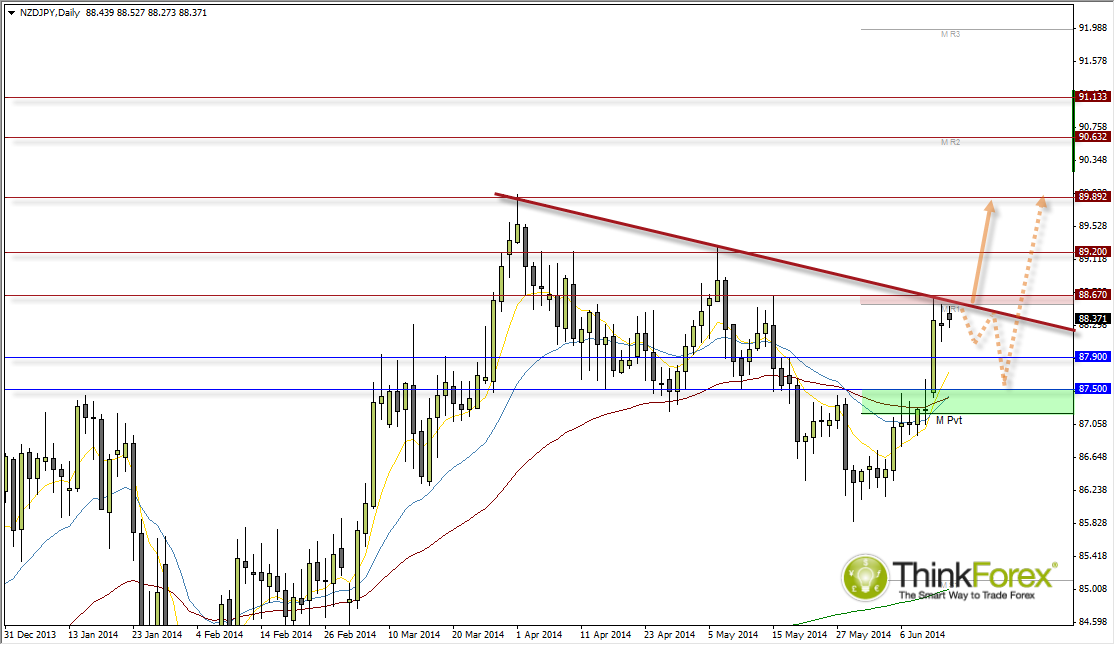

Following Thursday's rate increase price tested a sloping resistance line and thus far has continued to respect it. A relatively subdued trading Day on Friday produced a Rikshaw Man Doji beneath the Monthly R1 resistance which leaves the potential of a retracement or sideways trading on the table before the bullish movement continues.

For now I am favouring the breakout and one approach to consider as an EOD (End of Day Trader) is to place a buy stop above 88.70 zone to catch any breakout. The risk here is being triggered into a 'fakeout' and for price to retrace back below the original breakout line. Another risk is if we see a particularly violent breakout (like the +25 gap up on the rate hike) leaves room for a bad fill price, depending on how close to the breakout line you place the order.

Another approach (and one I regularly use myself) is to wait for the breakout, and look for bullish setups above the breakout line, or wait for any retracement back to this level before looking to enter.

In the event we do not see the breakout and begin to recycle back towards 87.50 then we have a good zone of support here which may create a 'higher low'. This would add further strength to the possibility of an eventual bullish breakout.

If we trade back below the Monthly Pivot then I suspect we may return to 85,0 but at this stage I consider this scenario to be of low probability. And for this to happen we would need RBNZ to openly state their decision to begin shorting the 'overvalued' Kiwi dollar. Until then, bullish breakout is the preference and for price to remain above 87.50.