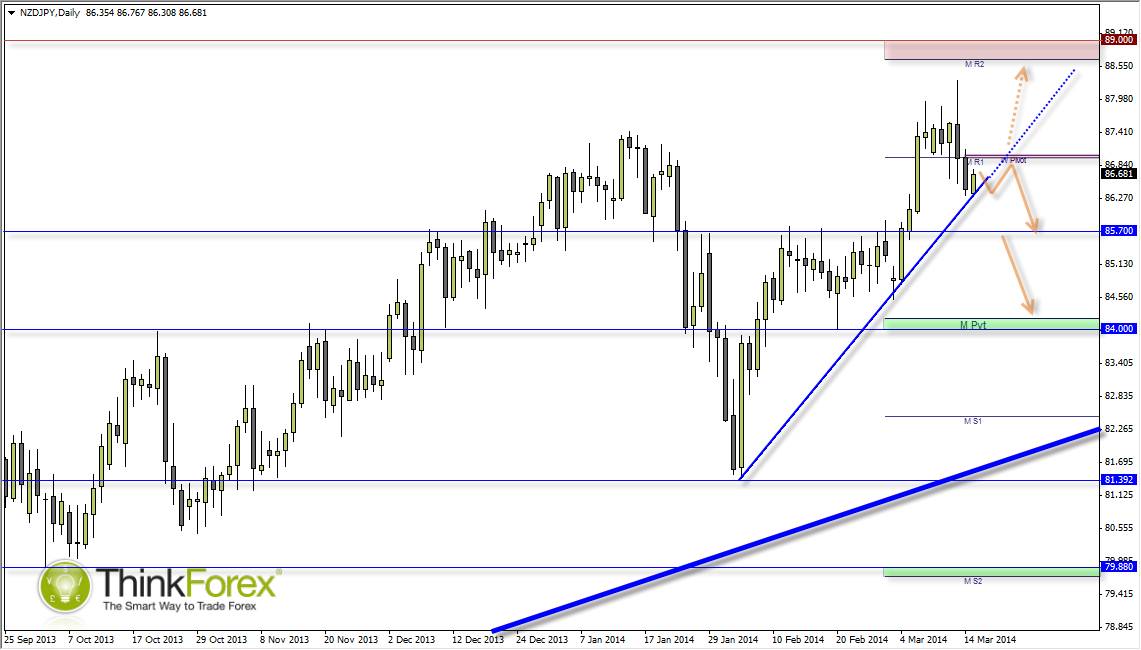

Up until last Thursday I thought the $0.89 target would have been achieved, but the Engulfing 'Spinning Top' Candle made sure this was not to be the case. As we have seen increasing volume go into JPY at the back of last week it is possible we may see a deeper retracement before the original target is hit.

NZD/JPY" title="NZD/JPY" height="242" width="474">

NZD/JPY" title="NZD/JPY" height="242" width="474">

Last week's candle closed with a Shooting Star Reversal just shy of our original target, while trading at 6-year highs. All this suggests is the potential for near-term weakness and for a bearish retracement against the dominant bullish trend, and by no means a call for a top. Those wishing to trade in line with the trend would be better to wait for the retracement to occur and seek bullish setups at support levels such as 85.70 or 84.0.

Looking ahead further what we may be witnessing is the beginning of a bearish wedge reversal; however this still leaves room for further highs over the coming month so I mention this for purely observational purposes.

What interests me about this chart is how we are holding onto a bullish trendline yet caught beneath a resistance confluence of horizontal resistance the Weekly Pivot. This provides 2 clear plans of action.

1 - Wait to see if the trendline holds and for price to break above resistance, to then target 89.00

2 - Wait for a break of the trendline and seek intraday bearish setups down to 85.70 support.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade.

A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.