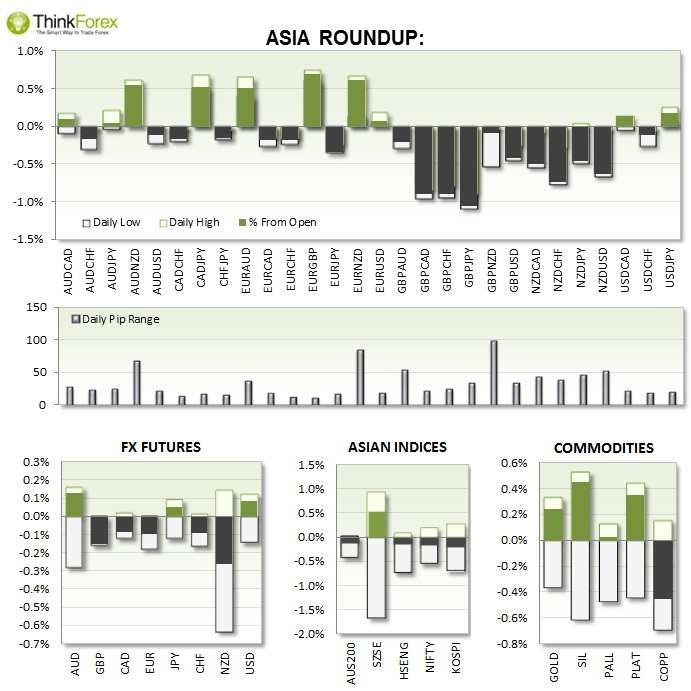

- AUD business confidence at highs not seen since October 2013 and rises for a 4th consecutive month.

- NZD House Price Index contracts a further -0.7% to see the 3rd consecutive decline. The Kiwi took a hit across the board and testing key S/R levels against USD, JPY and EUR. The AUD/NZD traded to a 3-day high.

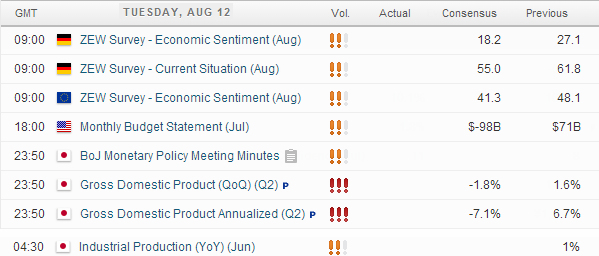

UP NEXT:

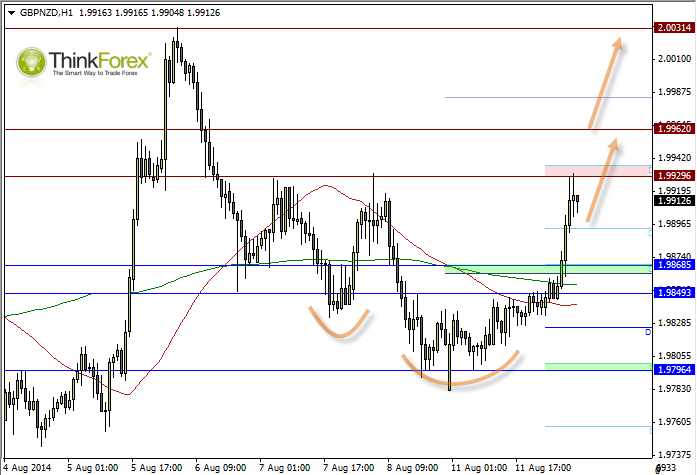

GBP/NZD: Bottoms up!

While it would appear at first we have missed a big part of the bullish move, there may be a longer-term opportunity to consider bullish setups above 1.9930-40. It appears to be a 'cup and handle pattern' although the handle (smaller rounded bottom) tends to be on the right and not the left. Still, it does highlight a clear breakout level - so if we do trade above the resistance zone we could seek bullish setups on lower timeframes in the direction of the breakout.

For those who wish to get in earlier we could consider buying any pullbacks at support levels to anticipate the breakout. A level to consider is around 1.9840.

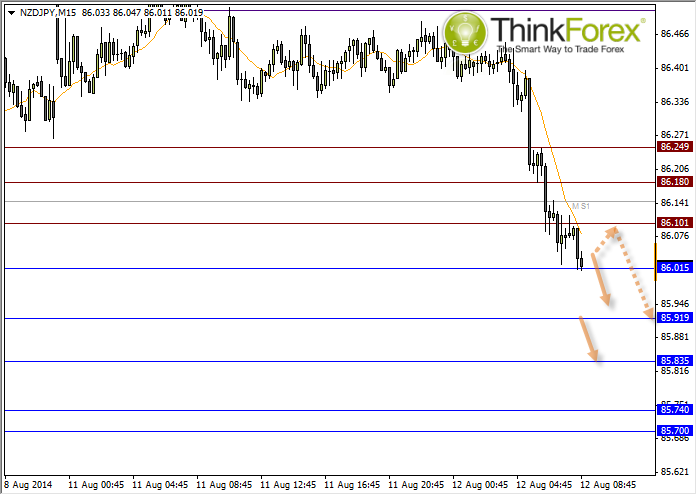

NZD/JPY: Intraday momentum is clearly bearish

It's not often I refer to the 5 min chart but the trend is well established and there are clear levels of S/R to consider as profit objectives or buy/sell zones in line with the trend.

As the Kiwi has by far been the biggest mover throughout Asia we are requiring for this sentiment to continue when Europe and London markets open.