Investing.com’s stocks of the week

The NZD/JPY has confirmed a pivotal swing low and with the fundamentals, sentiment, and technical on its side for further gains we can classify this is a higher-probability set-up.

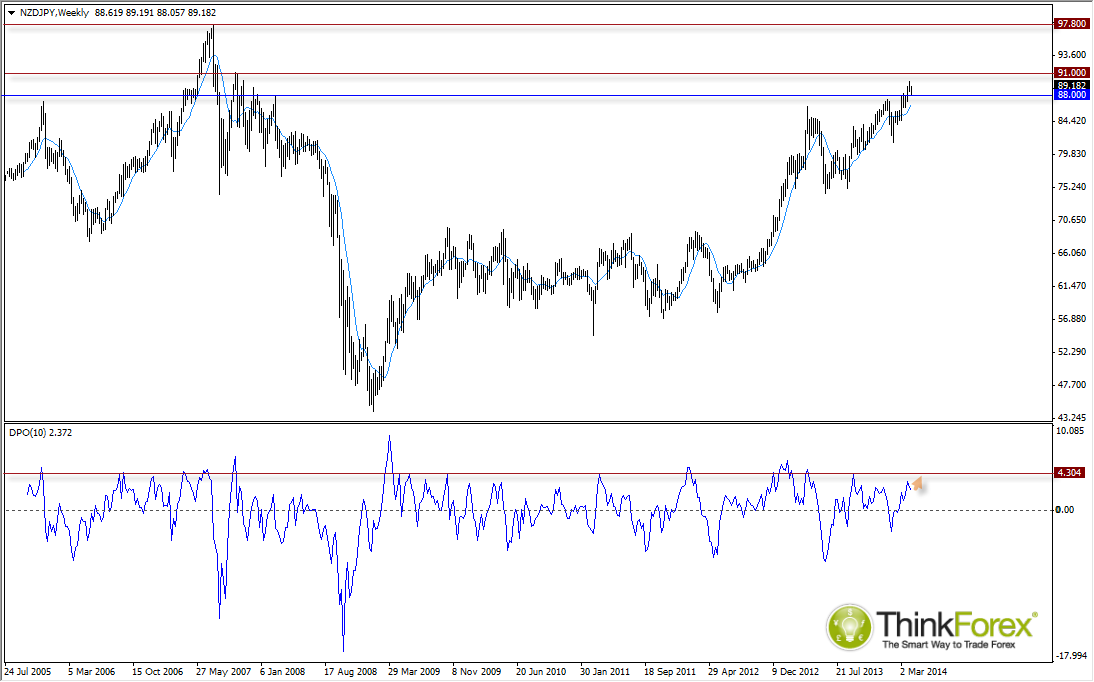

Above we can see a DPO (Detrended Price Oscillator) which measures the distance between closing price and a moving average (in this instance a 10-period sMA). I use this to assess the character of a currency and see typical ranges that price 'snaps back' to a moving average. It doesn't always work and it needs to be used loosely, but it can help quantify when price is due a retracement. I have noted that there is a tendency to return to the 10-week MA when price os +$4 above it and this leaves alittle more room for further gains from what I can see.

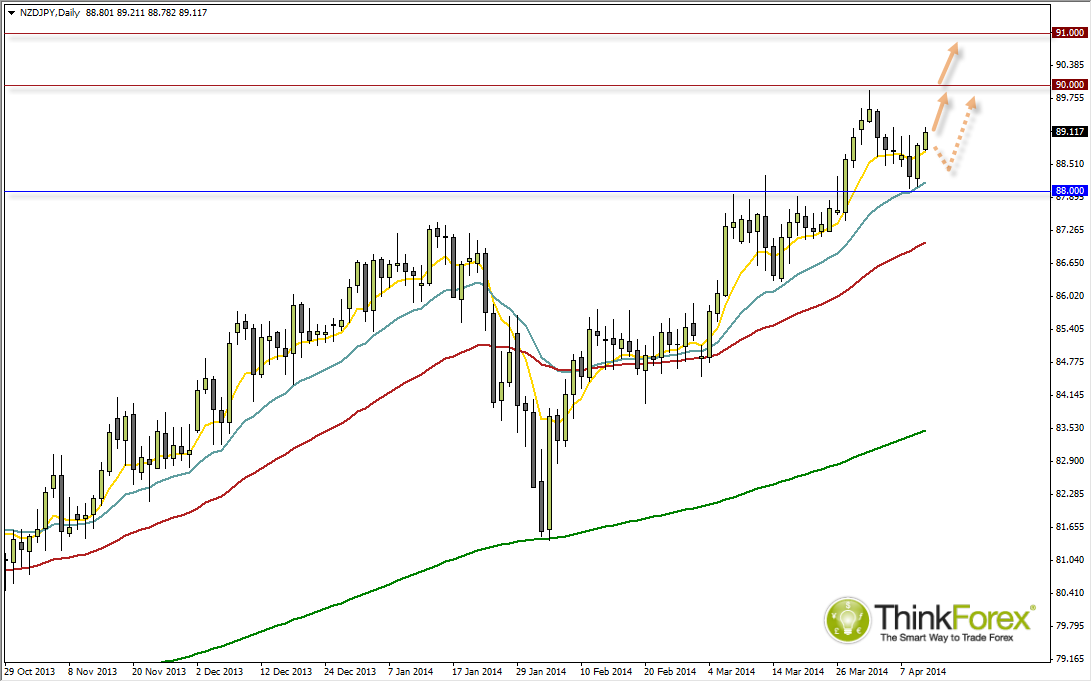

The daily chart exhibits all of the classic signs of a strong trend; higher highs/lows, moving averages are 'in order, and fanning out to highlight increasingly bullish momentum and the cycle lows are timely.

Yesterday's candle confirmed a bullish piercing line and early Asia trading has seen a continuation of the buying. Whilst the bias is clearly bullish there are two ways we can approach this potential set-up.

Assume price will continue to the initial 90.0 target, refer to a lower timeframes (H4, H1, M15 etc.) and swing trade towards the target.

Alternatively we can seek a bearish retracement and hope for price to come closer towards the 88.00 swing low and either buy at market or set a buy-limit order with a stop comfortably below 88.00.