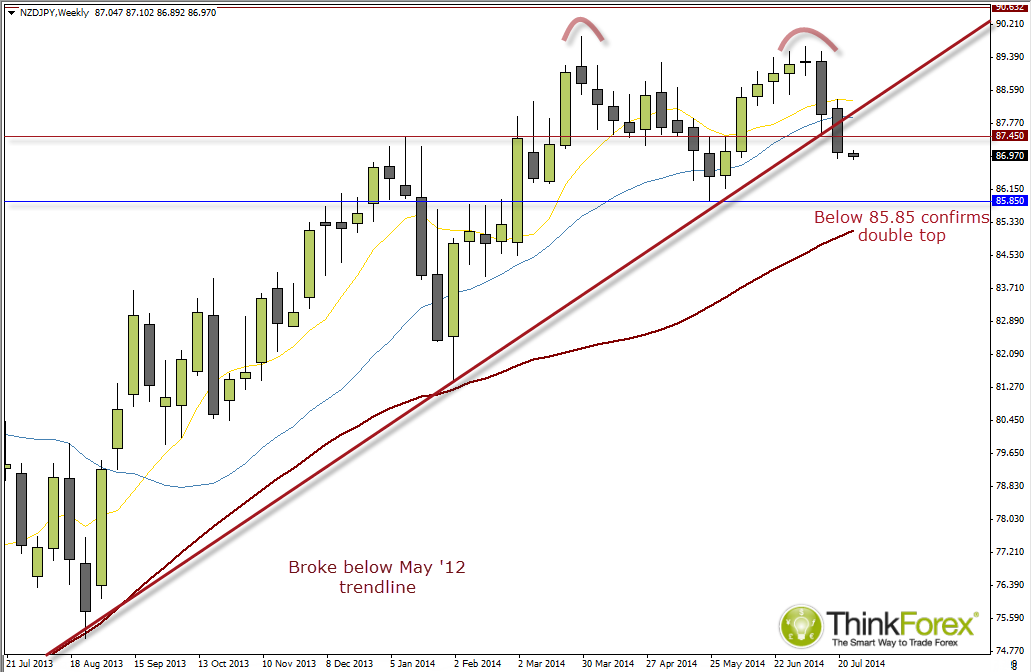

After highlighting the potential for a topping pattern to be forming, NZD/JPY losses accelerated to treat traders to some much needed volatility.

The week closed by breaking below the bullish trendline from the 2012 lows to suggest a deeper bearish move may be underway. Whilst not pictured above, we did previously highlight that the 50 period DPO had formed a bearish divergence and suggested a retracement back towards the 50-week moving average was likely. At time of writing the 50-week MA is around 85.14, but a more obvious price target is the 85.85 swing low in May this year.

The Futures volume shows that the decline was seen with suitably bearish volume so at this stage we expect to see the decline continue and for any rally to be capped by 87.45 resistances.

A break below 85.85 confirms a double top would target 82 but at this stage I suspect this level will hold, which leaves room for a Triple Top to form, or of course a bullish reversal.

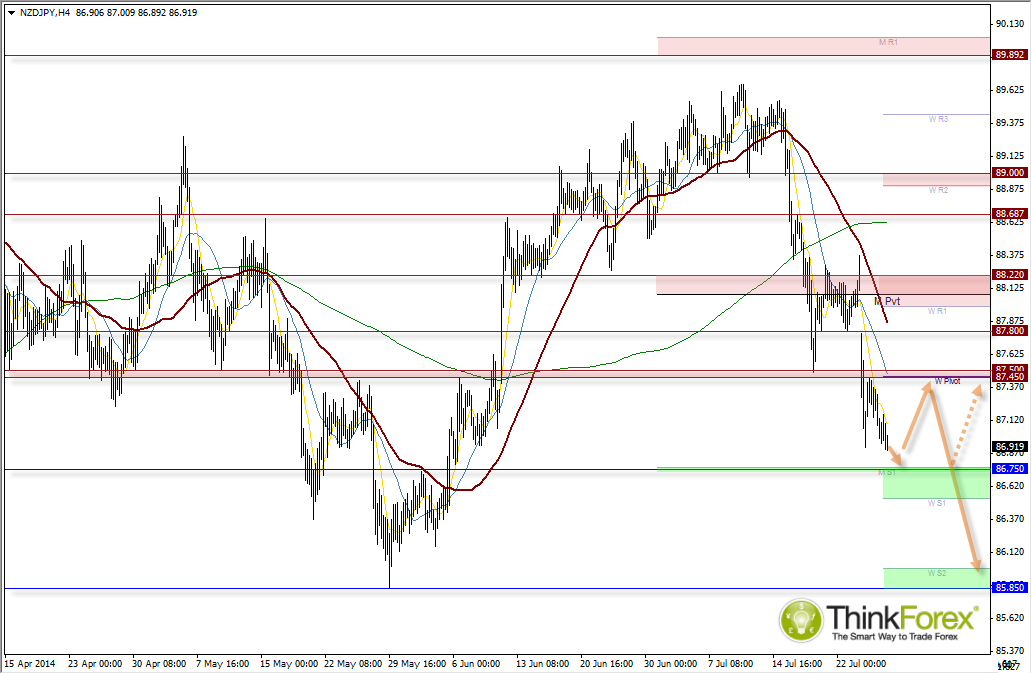

Currently trading near last week’s lows the decline has slowed somewhat but this still leaves room for a dip down to 86.76 (MS1) before we see any retracements. Take note of the breakaway gap which occurred when NZD raised interest rates. This gap appears to be a 'breakaway' gap (also called a measuring gap) which if successful will project a target around 85.90, May lows.

- Due to the gap I suspect retracements to be limited and for 87.45-50 to cap as resistance

- Break above 87.50 raises the odds of the gap closing

- A break above 88.40 invalidates the bias for price to test 85.85