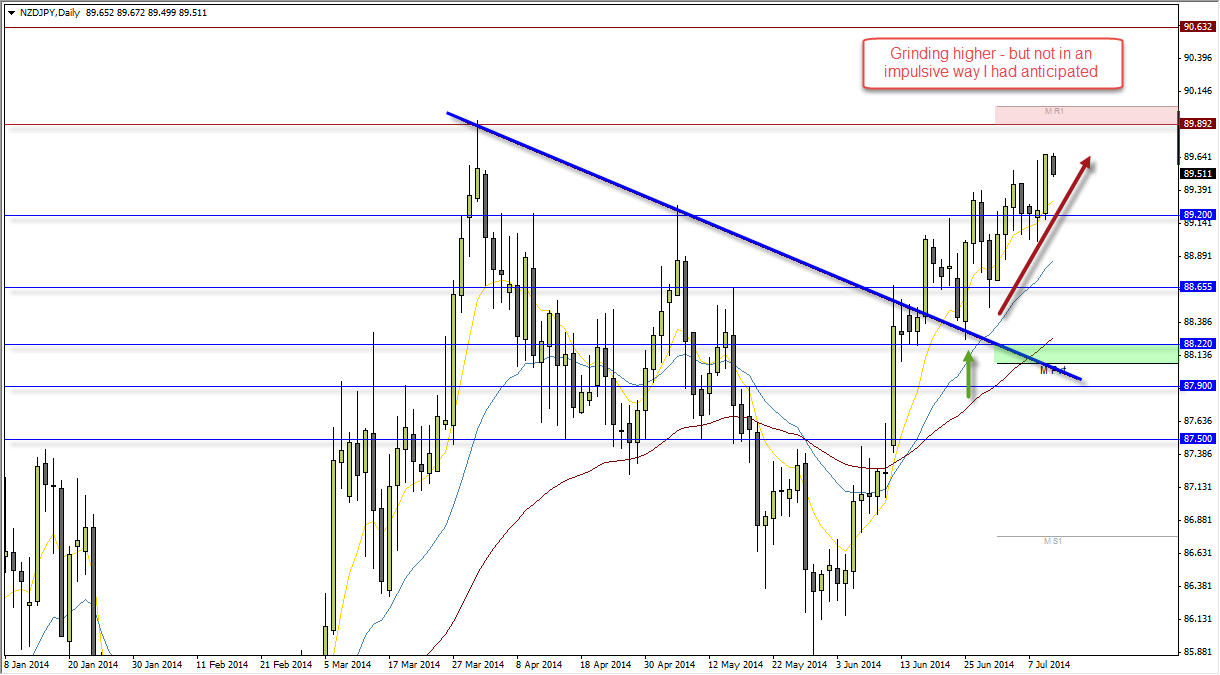

The retest of 88.20 had appeared promising for gains, at first. However, as the NZD/JPY grinds higher and without momentum we have to suspect a topping pattern may be forming.

The bullish engulfing candle which retested previous resistance around 88.20 had been my initial green light to seek bullish setups. While bullish setups have been occurring (mainly upon the intraday timeframes) I ‘m beginning to suspect all may not be rosy in the bull camp.

That is not to say we not see further highs but a quick scan of each leg higher should show you that it is achieved with slightly less upside as we approach the March swing high.

At this stage I would not be looking for bullish setups on D1 but may consider intraday bullish setups. But, at the back of my mind I'll be considering a downside break to confirm the bearish wedge highlighted below.

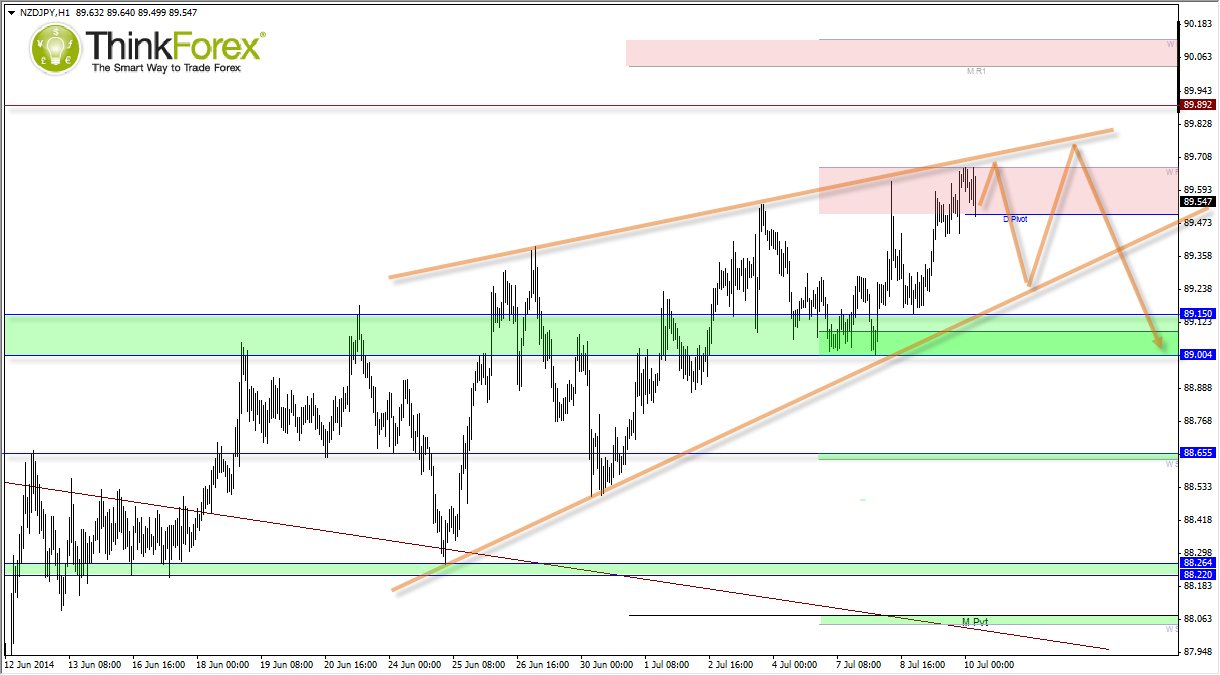

Current resting on the Daily pivot intraday bulls are likely to show interest at current levels. However, note the potential bearish wedge which may help cap as resistance, which is also near Weekly R1 pivot (and today’s highs).

Therefore be on the lookout for a downside break of the daily pivot and for price to target the lower support of the potential bearish wedge, with a break of this line confirming the bearish wedge and projecting an eventual target back near the base at 88.22. However, before we get too excited note the technical support levels around 89.00 - 89.15 which are likely to cause a price reaction at least.