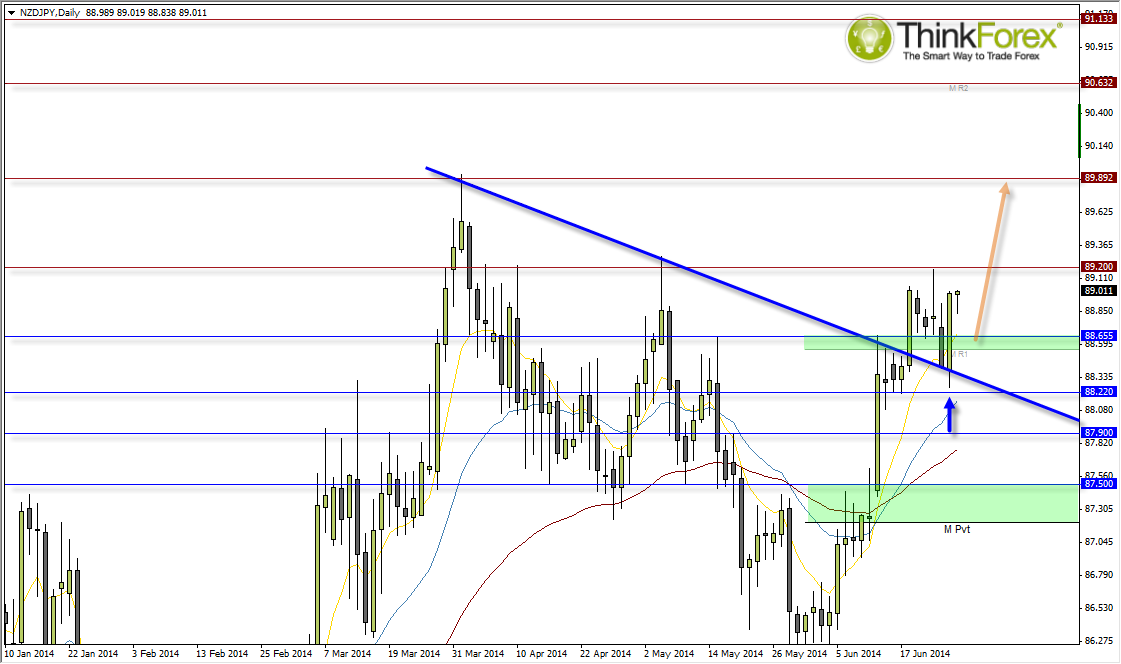

A bullish engulfing candle above support suggests a swing low has formed and for the correction to have been completed.

The Kiwi Dollar was the strongest Major single currency yesterday across the board following yesterday’s final GDP coming in at -2.9% vs -1% expected. This saw NZD/JPY produce a Bullish Engulfing Candle on D1 which had respected the previous breakout line to suggest a pivotal swing low has formed and for price to continue the bullish trend.

We had previously highlighted the potential breakout on 16th June and yesterday's price action provides another opportunity to join the trend if the original breakout had been missed.

Any retracements towards 88.60 could be used to seek bullish setups (assuming this level is respected) and a potential higher reward / risk ratio may be achieve. However there is also the possibility of a deeper retracement towards the broken trendline, however I consider this to be a lower probability due to the obvious buying dominance created during yesterday's session.

The next major catalyst for NZD is tomorrow' trade balance, followed by Japan Retail sales and Core CPI data.