The Kiwi Dollar had a positive start to the week as it climbed higher in anticipation of an interest rate hike tomorrow. Then Chinese Data came out...

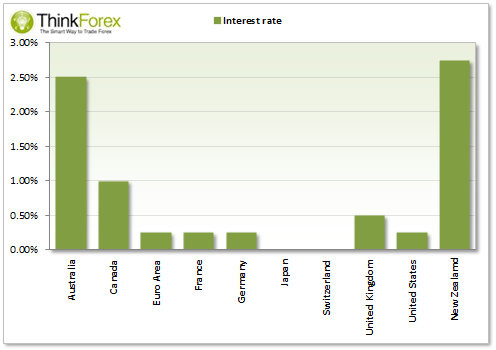

A cursory glance at the interest rates among G10 currencies and it is much easier to see what all of the fuss is about, and why NZD/JPY is the 'go to ' carry trade among G10 crosses. With NZD having the highest interest rates and set to increase them again tomorrow we have seen steady Kiwi Dollar appreciation this week in the lead up to tomorrow's rate announcement.

Today's disappointing numbers from Australian CPI and Chinese PMI have pretty much annulled any speculation of RBA raising interest rates any time soon, which leaves NZ at the top of the leader board with a good chance of extending this lead tomorrow to 3%.

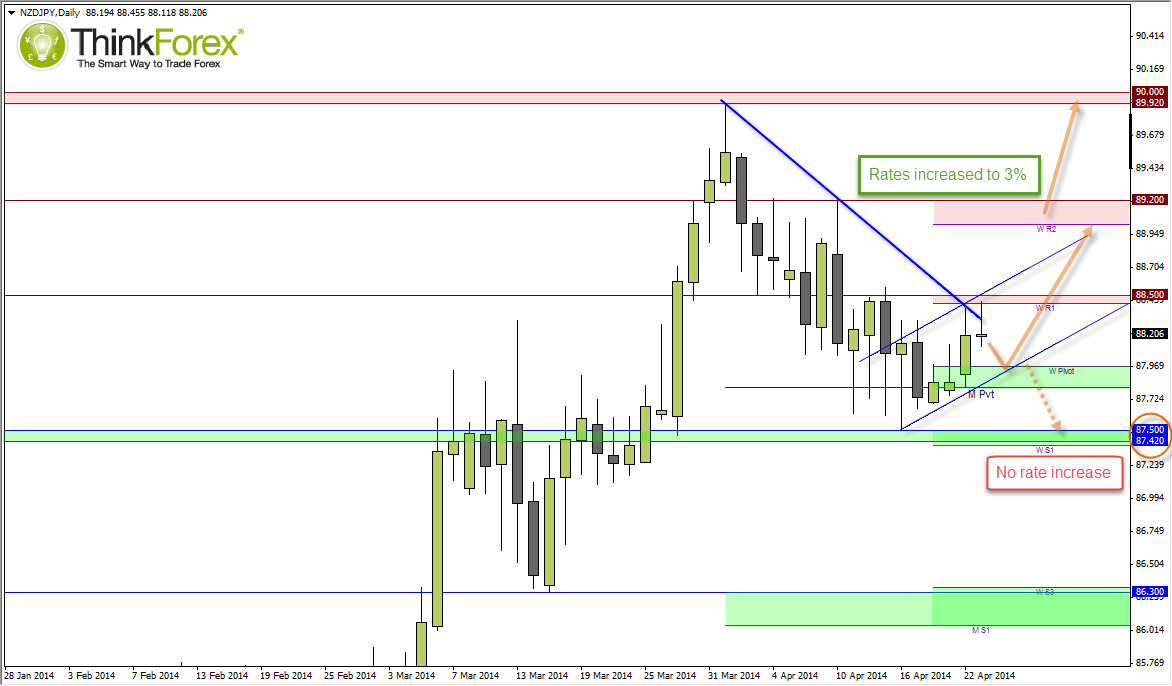

NZD/JPY climbed to a 6-day high, no doubt fuelled by those awaiting rate hikes tomorrow, but the poor Chinese Data put the cross 'back in its box' below 88.50 resistance and 87.50. The aforementioned box has housed NZD/JPY the past 9 trading sessions and my bet is we are witnessing a basing pattern before a resumption of the uptrend. If we can break above 88.50 resistance then I think we will be set for a run up to 90.

However there is a chance the rate hike is already priced into the market, so any decision to keep rates fixed could see NZD sell-off across the board and break key levels of support against USD and CAD. Even if this does happen I do not see it to have a lasting effect as the longer-term traders should keep their positions open, leaving only the short-term trades disgruntled with fixed a rate decision.

Potential scenarios

- Rates to 3%: 87.50 remains as a swing low and for price to target 89.20 and 90

- Rates fixed at 2.75%: NZD/JPY sells off down to 87.50; A break below here opens up 86.30

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI