New Zealand dollar continues to make new 8 year high against Australian dollar today as faster than expected inflation reading boosted chance of rate hike in near term. The CPI accelerated to 1.6% yoy in Q4, up from Q3's 1.4% and beat expectation of 1.5%. There are speculations that the RBNZ would hike the official cash rate from the current record low of 2.50% by 25bps at next meeting on January 30. Some economists noted that both inflation and growth have surprised on the the upside comparing to the mid-December forecast and that could give some pressure to the RBNZ to pull ahead the rate hike. Nonetheless, the chance for January hike is still at around 25% only as implied by swaps. The majority of economists expect that RBNZ would still wait until March meeting.

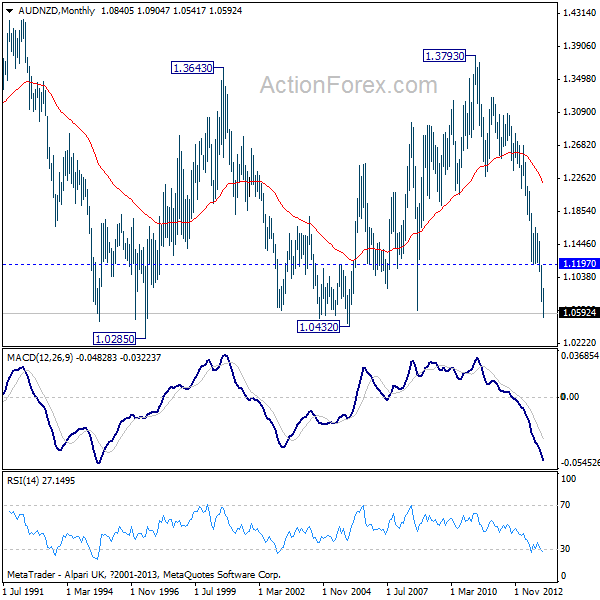

The AUD/NZD dropped through 2008 low of 1.0628 this month on expectation of diverging policy paths. While the RBNZ is expected to raise rate this year, there are increasing expectations of another rate cut from RBA after a string of weak economic data. Medium term outlook stays bearish as long as 1.1197 resistance holds and we'd expect deeper decline through 2005 low of 1.0432 to have a test on 1997 low of 1.0285.

AUD/NZD Monthly Chart" title="AUD/NZD Monthly Chart" width="474" height="242" />

AUD/NZD Monthly Chart" title="AUD/NZD Monthly Chart" width="474" height="242" />

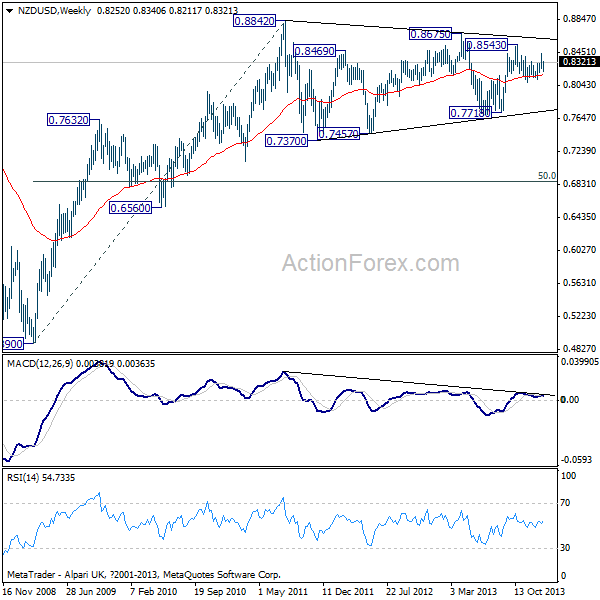

The NZD/USD strengthens mildly today. But after all, it's bounded in a long term sideway pattern well below the upper trend line resistance. From near term's perspective, the support from 55 weeks EMA would likely give NZD/USD the strength to climb back to 0.8543 high. But, we'd expect strong resistance below 0.8676 to bring reversal to extend the sideway pattern. It doesn't look finished yet.

NZD/USD Weekly Chart" title="NZD/USD Weekly Chart" width="474" height="242" />

NZD/USD Weekly Chart" title="NZD/USD Weekly Chart" width="474" height="242" />

Elsewhere, markets are staying in range in general but the Japanese yen seems to be reversing again. The economic calendar is not too heavy today. Main focus in European session will be on German ZEW economic sentiment which is expected to improve to 63 in January while current situation gauge is expected to rise to 34. Eurozone ZEW economic sentiment is also expected to improve to 70.2. UK will release CBI trends total orders. Canada will release wholesale sales and manufacturing shipments.