The dollar traded higher against most of its G10 counterparts during the early European morning. Traders seems to be ignoring any concerns over the ongoing US government shutdown and the upcoming debt ceiling debate that has pressured the US currency in recent days. The picture is also similar among EM currencies; the dollar stabilized or gained ground against the EM currencies with the major exception being the Indian rupee.

GBP was the biggest loser after UK industrial production unexpectedly fell in August (-1.1%% mom vs +0.4% mom expected and flat mom in the previous month). Cable plunged immediately after the data release, moving below the psychological level of 1.6000. I believe the decline is overdone and we could see it recover that key level ahead of tomorrow’s Bank of England meeting.

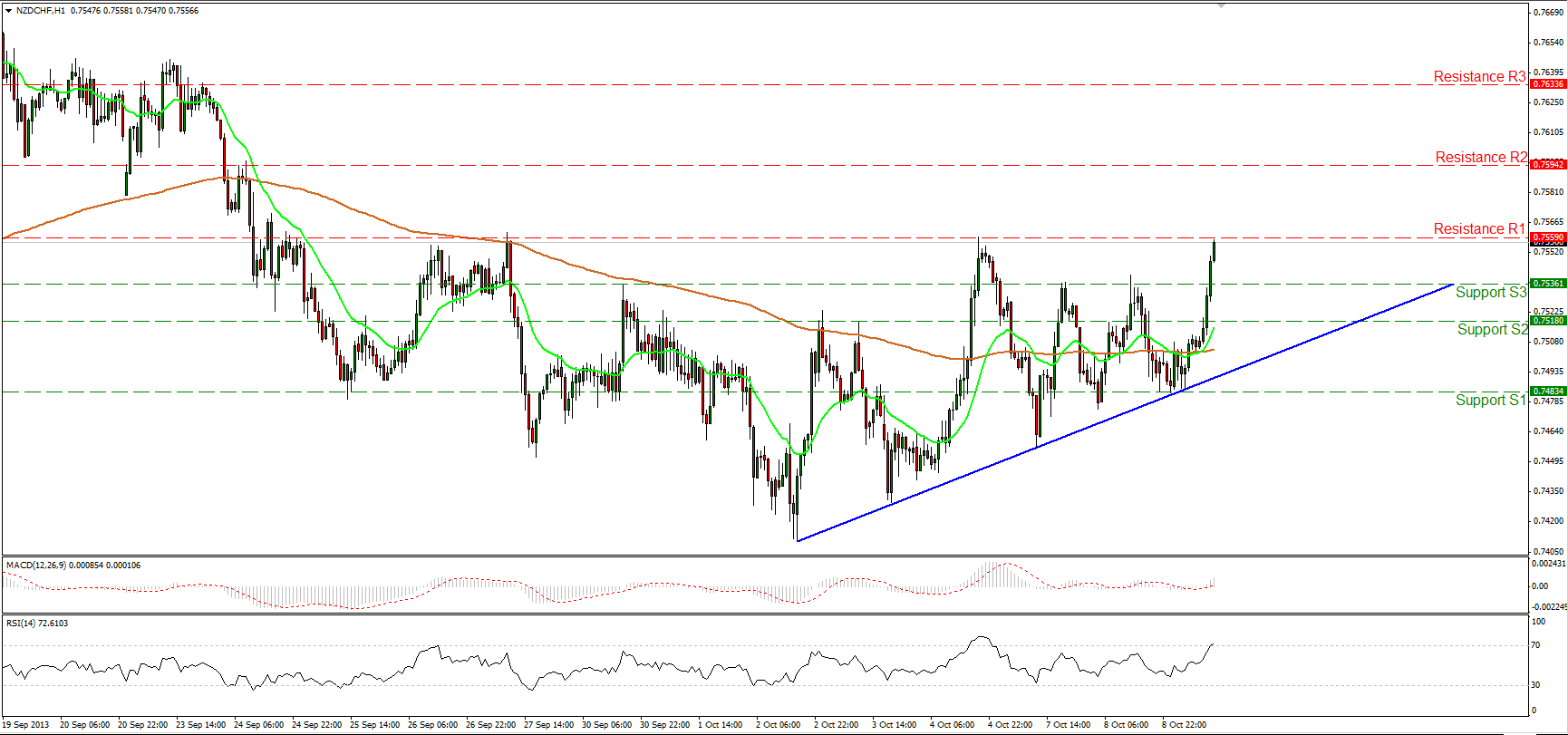

I suggested in the morning comment selling NZD/CHF from a fundamental point of view. This morning’s market action gives a better entry point, which is another way of saying the trade has gone contrary to what I expected. From a technical point of view (see below) it looks likely to continue moving higher. Yet from a fundamental basis, I do think the FX market is underestimating the possibility that the crisis in Washington goes further than expected. The Republicans apparently expect that either the Democrats will fold or the Treasury will be able to pay its bonds by not paying other bills. I doubt the former will happen, and if it comes to the latter – in effect, selective default – the safe-haven trade would quickly come back into style.

NZD/CHF surged during the European morning, violating two resistance barriers in a row. During the early afternoon, the pair is found testing the strong ceiling at 0.7560 (R1). If the enthusiasm of the bulls continues and manages to overcome this ceiling, I expect them to extend their move towards the next resistance at 0.7594 (R2). The MACD oscillator entered its bullish territory and also achieved a cross above its trigger line, confirming the bullish attitude of the pair. However, future consolidation cannot be ruled out, since the RSI is ready to enter its overbought zone.

- Support: 0.7536 (S1), 0.7518 (S2), 0.7483 (S3)

- Resistance: 0.7560 (R1), 0.7594 (R2), 0.7633 (R3)

NZD/CHF" width="1730" height="811">

NZD/CHF" width="1730" height="811">Disclaimer: This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients’ orders. This material is just the personal opinion of the author(s) and client’s investment objective and risks tolerance have not been considered.

IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited. Risk Warning: Forex and CFDs are leveraged products and involves a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. IronFx Financial Services Limited is authorised and regulated by CySEC (Licence no. 125/10). IronFX UK Limited is authorised and regulated by FCA (Registration no. 585561). IronFX (Australia) Pty Ltd is authorized and regulated by ASIC (AFSL no. 417482)