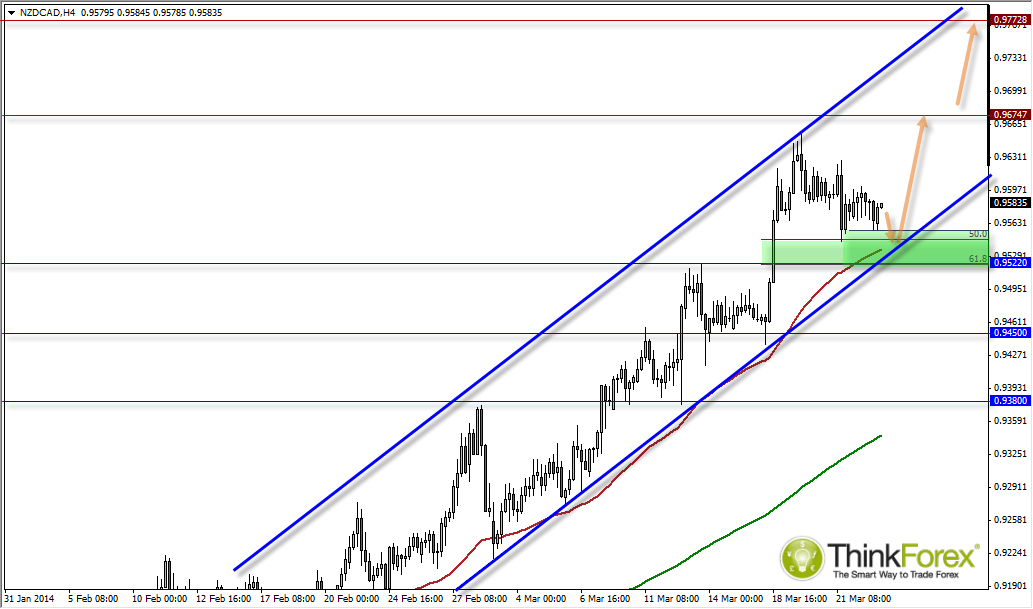

Since last week's record high the NZD/CAD pair has drifted slowly towards the 50% retracement level which is also accompanied by several confluences of support.

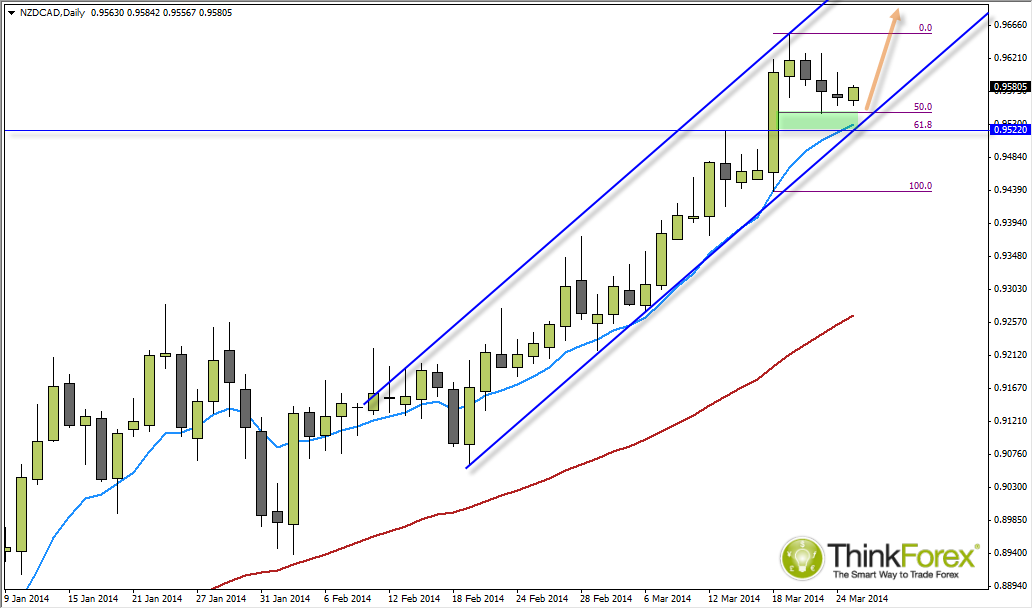

Since the Spinning Top Doji last Wednesday the daily candles, despite being down days, have continued to suggest the weakness may be short lived. Following the Spinning Top we have an INside Day and subsequent Doji which respected the 50% retracement level and yesterday produced a Rikshaw Man Doji which itself was inside the previous days range. These 3 candles hardly paint the picture of a pending bear market.

We are still trading near record highs and in the event we break below the 50% we also have the 10 day eMA, 61.8% and pivotal S/R which may provide additional support around the bullish trendline.

Taking into account the strong bullish trend and accompanying fundamentals between the two countries, another new high is a plausible and likely scenario...

Alternatively if we do see a break below 0.9520 then we could take this as a reversal signal as this would then break the bullish channel and support zone, to confirm change in market sentiment.