The kiwi dollar rallied strongly following the RBNZ’s announcement that the Official Cash Rate (OCR) would be cut 25bps to 2.50%. However, instead of the bears rushing in and causing a sharp depreciation, RBNZ Governor Wheeler’s statement suggested that any further policy action would be unlikely in the near term.

The New Zealand dollar subsequently rallied sharply in response to the statements as the market digested a significant softening in the venerable central banker’s tone. Specifically, the RBNZ statement suggested that the 90-day rate forecast was nearing 2.6 per cent by Q3, 2016. This would seem to suggest that the RBNZ sees no further easing on the horizon throughout 2016.

However, the reality of that forecast is directly linked to the state of the global economy as New Zealand exports fall prey to continuing rounds of currency depreciations throughout Asia Pacific. Given the current slowdown in China’s domestic economy, a continuing slide to global dairy prices could be a very real downside risk to the NZ economy. Subsequently, any 90-day rate forecast should be taken with a very large grain of salt.

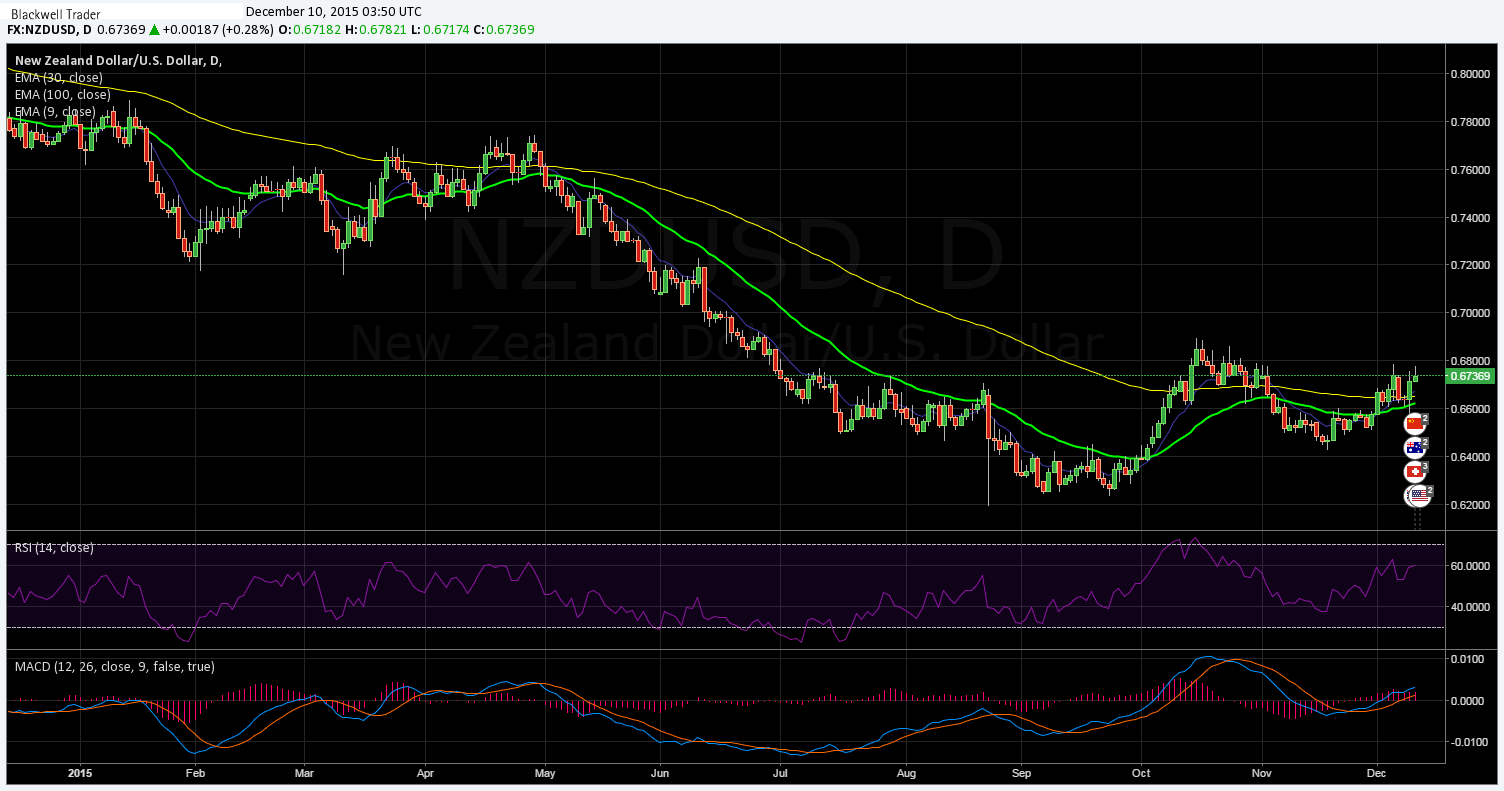

Despite the monetary policy statement spurring a rally to around the 0.6735 level, the NZD still remains under the grips of the long run bearish trend line. There would need to be a significant risk event for the Kiwi Dollar to finally break the down trend and stronger USD sentiment. However, that prospect would seem relatively unlikely given the looming risk of a rate hike from the upcoming Federal Reserve FOMC meeting.

Subsequently, expect the NZD to again experience some sharp selling pressure in the lead up to the FOMC decision. If the US Federal Reserve follows the prescribed playbook and raises the federal funds rate by 25bps, you will likely see the NZD fall sharply to trade well under the 65 cent handle. This would effectively return the currency to the near linear down trend of the past 6 months and bears would start to eye the lows around 0.6235 in short order.

In conclusion, although the NZD might currently appear to finally be breaking free of the bear trend following the RBNZ rate cut the reality is quite different. The downside risks are mounting ahead of the FOMC meeting and a change to market equilibrium is highly likely in the coming days.