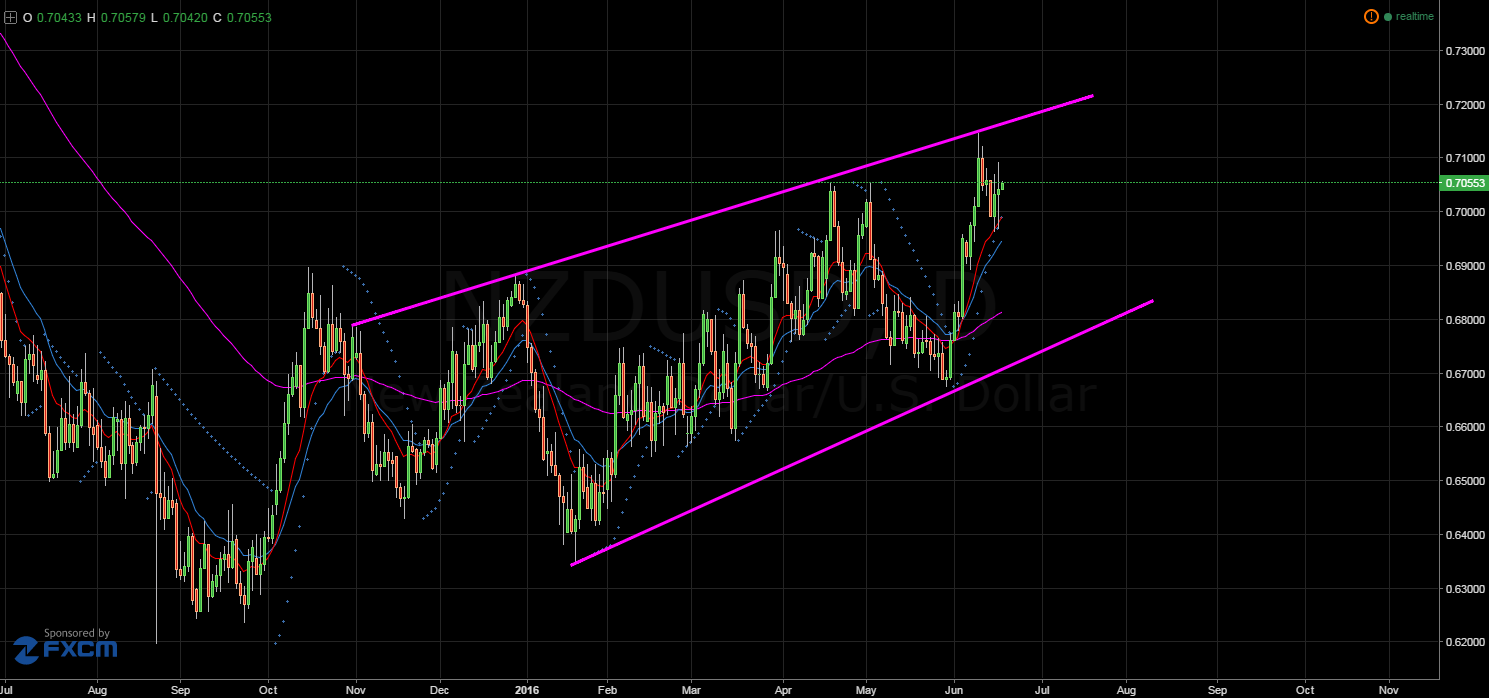

The kiwi dollar has been recovering strongly over the past few weeks after it tested the lower constraint of its bullish channel. After a stint of protracted gains, the NZD/USD is now nearing the upside constraint of the channel which could be hinting that the pair is poised to take a plunge lower again.

Additionally, such an outcome looks to be all the more likely given the previous session’s surge in USD sentiment. However, the kiwi dollar might not be done rallying just yet as a consolidation pattern could signal that another upside breakout is due next week.

Firstly, a look at the daily chart shows that a bullish channel remains firmly in place for the NZD/USD. In addition to the channel, strongly bullish EMA activity is signalling that the pair still has some upside potential in the medium to long-term. Furthermore, daily Parabolic SAR analysis is still bullish which confirms the long bias on the pair.

Additionally, upon inspecting the stochastics of the kiwi dollar it is evident that the pair has yet to become oversold or overbought. Consequently, there is room for the NZD/USD to move in either direction despite nearing the upside constraint. This being said, there is some strong evidence that the pair is poised to move lower in the short term before having a bullish breakout.

As shown on the H1 chart, the presence of a falling wedge formation should cause the kiwi dollar to move lower prior to any long-term bullishness resuming. Following the current trends of lower highs and higher lows, a breakout would likely eventuate mid-way through next week at the earliest. As this point approaches, keep watch on Bollinger band activity as any noticeable narrowing could precede the pair’s upside breakout.

Ultimately, next week is relatively news-light which will leave the kiwi dollar slightly more beholden to technical manoeuvres than usual. Consequently, keep a close watch on the falling wedge pattern as it completes on the H1 chart as it could be key in getting in front of a breakout. Additionally, narrowing Bollinger bands could likewise be useful in identifying when the NZD/USD decides to resume its long-term bullishness in earnest.