The New Zealand economy faces a range of headwinds that could prove highly bearish for the NZD in the latter part of 2015. However, despite the negatives, the domestic economy is proving relatively robust in light of the unravelling global slow down.

The New Zealand economy continued to grow at an annual rate of around 2.4% y/y, buoyed by increased net migration, a supportive monetary policy, and exchange rate depreciation. However, the continued decline in the Global Dairy Trade (GDT) auction prices has impacted the economy strongly and has placed export revenues under pressure. In fact, newly released results from Q2, 2015, saw a significant beat as GDP growth fell below forecasts at 0.4% q/q (0.6% exp).

The rout in global dairy prices has also strongly impacted the New Zealand Trade Balance with July and August showing a contraction of NZD$-649m and NZD$-1035m respectively. Given New Zealand’s strong dependence on international trade, along with the dairy sectors relative importance, it is no surprise to see the sharp deterioration in the terms of trade.

The labour market has also felt the pressure of slowing activity within the dairy sector with the unemployment rate increasing from 5.8% to 5.9% in July. In fact, unemployment is forecast to worsen throughout the remainder of the year with the Q3 result estimated to rise to 6.1%. Despite the deteriorating labour market, skill shortages are still evident and this has seen average hourly earnings rise to $29.04 in July.

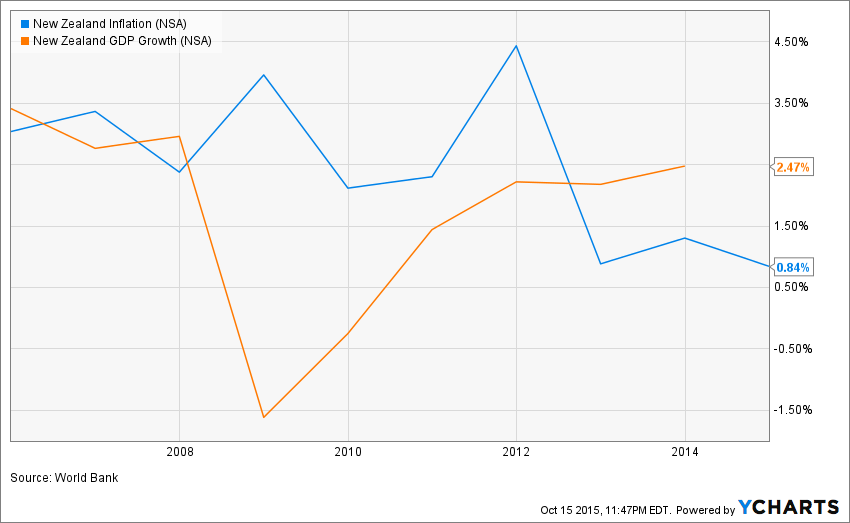

However, inflationary pressures have been largely absent from the economy despite July’s result for Q2 showing a slight uptick to 0.4% q/q. The rise in inflation is largely due to spiralling pressures within the Auckland housing market, along with cigarettes and tobacco. Subsequently, the Reserve Bank of New Zealand (RBNZ), faced with the lack of persistent inflation, and a deteriorating economic environment, took decisive action to cut the official cash rate 25bps to 2.75%.

The RBNZ’s move to loosen monetary policy has provided some much needed stimulus to the slowing domestic economy whilst at the same time strongly depreciating the New Zealand dollar. Since July, the NZD has declined steadily against the US dollar, from 0.6732 to 0.6386, aided largely by growing USD strength as well as an accommodative monetary policy. The depreciation will largely be supportive for New Zealand exports and tradables, which will be essential in supporting the dairy industry.

Economic Outlook

The New Zealand economy continues to grow at a below trend pace, however, the historically low OCR rate and a weaker NZD are expected to keep the economy on an even keel. These positive forces are expected to smooth out the downside before the economy sees an uptick in the business cycle over 2016. GDP growth is expected to remain subdued throughout Q4, 2015, and is forecast at 2.40%. However, headwinds are mounting in the form of stress from declining dairy prices, a fading incremental impetus from the Christchurch rebuild, as well as global ructions.

Annual inflation is expected remain well below 1.00% throughout the remainder of 2015. However, continued depreciation within the NZD is likely to help push the headline rate back towards the bottom of the RBNZ’s inflation target in the latter part of 2016. Despite the assistance that an accommodative monetary policy and exchange rate depreciation provides the economy, we are strongly of the opinion that there is likely to be a prolonged period of lacklustre core inflation, due to fundamental changes in the inflation process.

Subsequently, given the risk of a prolonged period of weak inflation, further accommodative monetary policy from the RBNZ is highly likely. The final quarter of 2015 is likely to provide some diminished demand conditions for the wider global economy which could spur the RBNZ to consider further rate cuts in late October. However, the central bank is primarily data driven and core inflation would have to decline further to justify another 25bps cut to the OCR in 2015.

The NZD remains strongly biased to the downside given the weakness in the current account balance, commodity price declines, and stronger USD sentiment. However, in the absence of any external shocks, the pace of decline should be relatively slow. The risk of a rate hike by the US Federal Reserve is the largest factor of uncertainty and any move by the central bank to normalise their monetary policy could send the NZD tumbling. Given the increased risk profile, it is safe to say that a NZD/USD valuation below the 65 cent handle is likely to persist into 2016.

Ultimately, despite the recent rally, fuelled by a risk-off approach to the USD, the NZD is likely to remain relatively bearish moving forward. Given the confluence of uncertain global conditions, as well as the change of further cuts to the OCR, mean that the Kiwi dollar is likely to find the going tough in the coming months. So position your risk accordingly, and watch for future easing from the venerable RBNZ.