Add business sentiment to the growing list of economic data that continues to outperform expectations in NZ.

Back in Q3 the index has dropped to its lowest level since 2009 at -40. And whilst Q4’s read is still technically pessimistic at -21, it has almost halved in just one quarter and posted its strongest quarter over quarter rebound in four years of +19 points. Still, the Service sector stands at -26 and is more pessimistic than the manufacturing sector, and firms remain cautious about hiring and investing. So, business sentiment is not completely out of the gloomy woods, it is heading the right direction to make an escape.

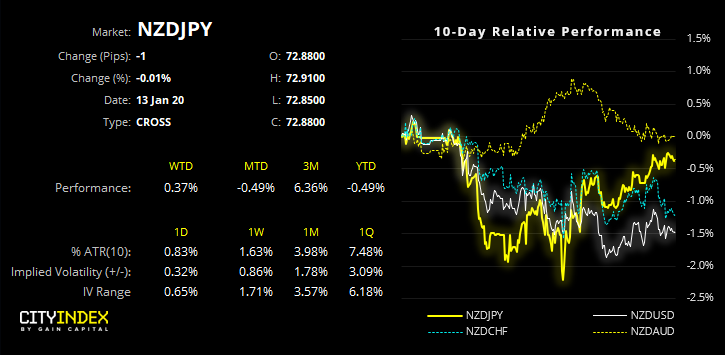

We highlighted four NZD crosses we were closely monitoring for a potential turning point, 3 of which have a positive carry. Out of the four, NZD/JPY is clearly taken the lead and potentially heading to retest December’s high. A weaker yen in anticipation of tomorrow’s US-Sino trade deal being signed is clearly helping to support. Of course, it will make an ideal candidate for bears to attack of it spectacularly falls through last minute, but this is an outside chance at present.

NZD/JPY: Overall, the daily trend structure remains firmly bullish. An elongated bullish hammer respected the 50 and 200-day eMA’s, and the 50 had already crossed above the200 whilst both point higher. More recently, price action has respected the 20-day eMA and yesterday’s candle closed at a 7-day high.

Price Action Update:

EUR/NZD: The bias still remains bearish below 1.6868, although a pick-up of Euro Zone data means it’s yet to roll over. So until either NZ or EZ data underperforms expectations, we could find price action is to remain choppy.

NZD/USD: It’s just about hanging onto its bullish trendline, a break of which invalidates the bullish bias. Yet if it is to rebound from current levels, it will retain its bullish structure. One to watch for now.

NZD/CHF: It’s back below the 200-day eMA with the 50 and 20-day curling lower. So whilst it remais above key support around 0.6405, momentum is pointing the wrong way. We’d prefer to see bullish momentum return before becoming more confident it will break to new highs.