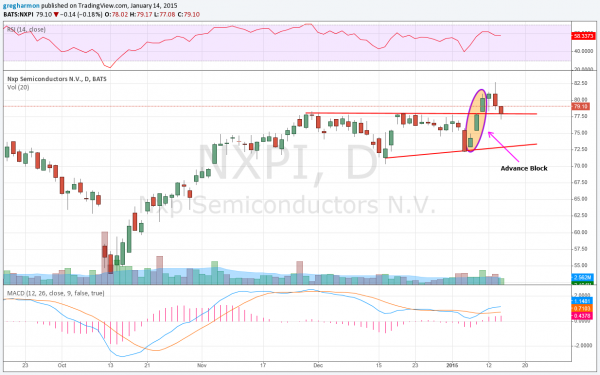

Sometimes a trade set up looks too good to be true. NXP Semiconductors (NXPI) was one of those for me this past weekend. It had just closed the week with a strong run higher from a higher low. It broke above trend resistance, and triggered a target of 84.65 out of an ascending triangle. The RSI was rising and positive while the MACD had crossed up and was rising. All was rosy and a typical bullish set up that I would get excited about to continue higher.

Except for one thing. An Advance Block. This is a Japanese Candlestick pattern that looks very much like the three Advancing White Soldiers pattern. That is a bullish continuation pattern. But the difference with an Advance Block is that the 3 candlesticks higher do not overlap, but rather show gaps between them. This is a sign that the rise has happened too quickly and it may exhaust.

I kept it off of my Top 10 list for this reason, but it stayed on my trading radar. And it turns out that was the right call. It did exhaust Monday and retreated the following two days. It now sits on the break out level. And this tells me it was also correct to keep it on the radar.

A hold and reverse here would carry that same target to 84.65 higher, but after having worked through that excess momentum. Conversely a breakdown through the support would target a move to the bottom of the triangle at about 72.75. A $6 move on a bounce or a $6 move on a breakdown. Now it gets interesting.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.