NVR Inc (NYSE:NVR). constructs and sells single-family detached homes, townhomes and condominium buildings. NVR stock is up by ~1100% since March 2009, climbing from $310 to roughly $3700 a share. Not bad for a company operating in one of the hardest hit sectors during the Financial Crisis.

However, NVR stock lost 67% between July 2005 and March 2009, so it is fair to say that economic recessions are not good for NVR shareholders. Now, with another recession seemingly on the horizon, is NVR worth the risk? The Elliott Wave analysis below suggests it isn’t.

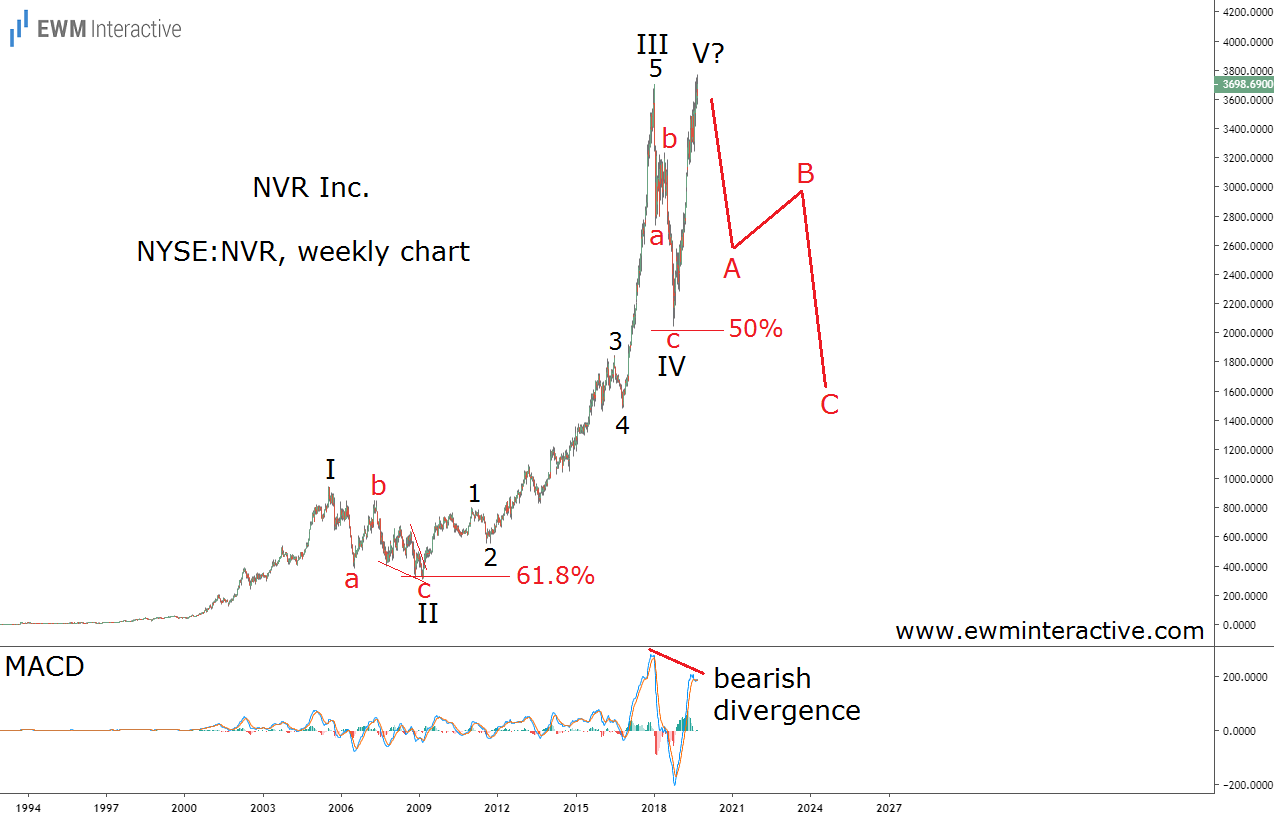

The weekly chart of NVR stock reveals that its progress for the past twenty years has resulted in a textbook five-wave impulse. The Financial Crisis corresponds to the a-b-c regular flat correction in wave II. It ended shortly after touching the 61.8% Fibonacci level and gave the start of wave III.

NVR stock reached $3700 a share in January 2008, but spent the next ten months in pullback mode. By October 2018 NVR was down by 45% in wave IV. Wave V, which appears to be in its final stages, pushed the share price to a new all-time high of $3770 earlier this month.

NVR Stock is a Very Risky Bet

The Elliott Wave theory states that a three-wave correction in the opposite direction follows every impulse. If this count is correct, it makes sense to expect a corrective decline to erase all of wave V’s gains and then some. The MACD indicator supports the negative outlook with a bearish divergence between waves III and V.

The anticipated plunge can wipe out roughly 50% of the company’s market value. With a recession very likely and a complete impulse pattern already in place, NVR stock looks like a very bad choice.