NVIDIA (NASDAQ:NVDA) needs no introduction. The company has been a GPU market leader for decades, but it only became a household name two years ago.

Its H100 chip made it the poster child of the AI revolution and propelled its stock price up more than ten-fold since late 2022. We’ll leave the question of the sustainability of AI capital spending to industry experts.

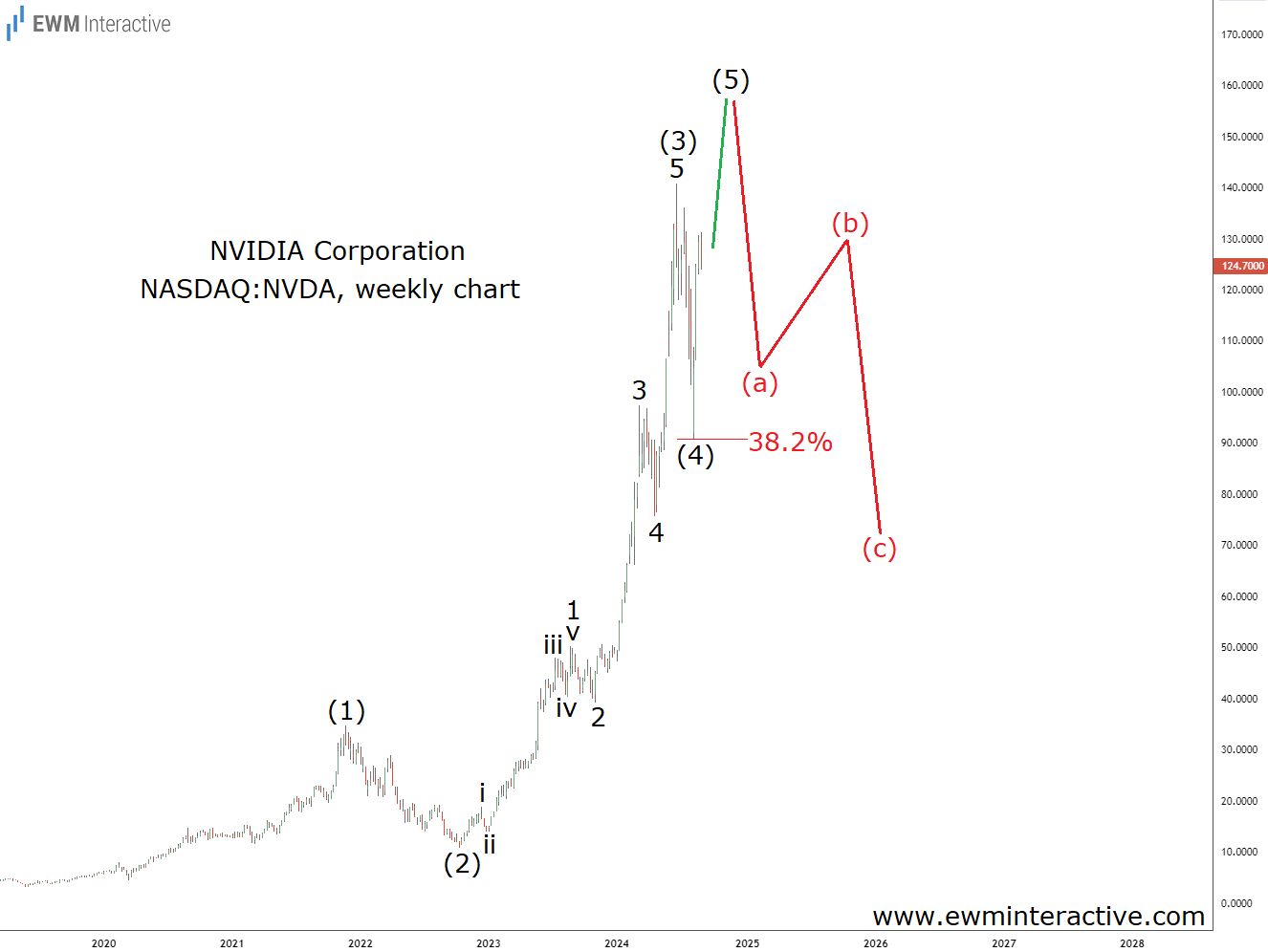

What we’ll instead focus on is the very clear Elliott Wave pattern the stock seems poised to complete heading into NVIDIA ‘s Q2 earnings report due out on August 28th.

A new all-time high would complete a five-wave impulse pattern, which has been in progress since at least 2019. We’ve labeled it (1)-(2)-(3)-(4)-(5), where the five sub-waves of wave (3) are marked 1-2-3-4-5 and the five sub-waves of wave 1 of (3) are visible, as well.

Wave (4) was a sharp pullback down to the 38.2% Fibonacci support level, where fourth waves often end. This strengthens our conviction that the current recovery is the fifth and final wave of NVIDIA ‘s phenomenal surge.

Fifth waves almost always exceed the end of the third wave, so it makes sense to expect a new record soon. Alas, once that happens, the entire impulse pattern would be complete and a three-wave correction in the opposite direction should follow.

So regardless of how good NVIDIA ‘s Q2 earnings report may be, we have no plans to join the bulls anytime soon. The anticipated bear market could easily cut the stock price in half or worse.