Nvidia Corporation ( (NASDAQ:NVDA) ) just released its fourth-quarter financial results, posting earnings of $1.78 per share and revenues of $2.91 billion.

Currently, NVDA is a Zacks Rank #2 (Buy), but that could change based on today’s results. The stock is currently up 7.21% to $233.20 per share in after-hours trading shortly after its earnings report was released.

Nvidia:

Beat earnings estimates. The company posted earnings of $1.78 per share, crushing the Zacks Consensus Estimate of $1.16. Earnings were $1.72 per share on a non-GAAP basis.

Beat revenue estimates. The company saw revenue figures of $2.91 billion, beating our consensus estimate of $2.67 billion.

Earnings were up 80% from the year-ago period. Total revenues climbed 34%. Revenues in the Gaming division were $1.739 billion, up from $1.348 billion last year. Datacenter revenues soared to $606 million from just $296 million a year ago. Automotive revenues touched $132 million, up from $128 million in the prior-year period.

“Industries around the world are racing to incorporate AI. Virtually every internet and cloud service provider has embraced our Volta GPUs. Hundreds of transportation companies are using our NVIDIA DRIVE platform. From manufacturing and healthcare to smart cities, innovators are using our platform to invent the future,” said CEO Jensen Huang.

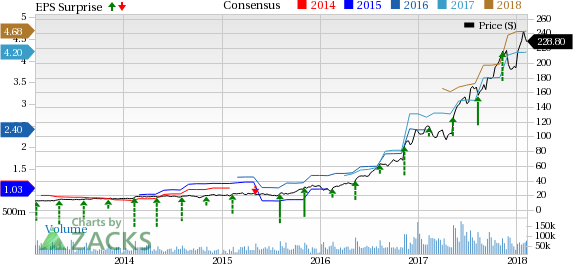

Here’s a graph that looks at Nvidia’s recent earnings performance:

NVIDIA Corporation is the worldwide leader in graphics processors and media communications devices. Nvidia designs graphics processing units (GPUs) and system on a chip units (SoCs). The Santa Clara, California-based firm’s traditional business focuses on delivering GPUs to the gaming market and SoCs to the mobile computing market. Nvidia is also considered a leading supplier for “smart” vehicles, datacenters, cryptocurrency mining, artificial intelligence, and autonomous driving.

Check back later for our full analysis on NVDA’s earnings report!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research