The American semiconductors company NVIDIA Corporation (NASDAQ:NVDA) specializes in designing graphics processing units (GPUs) for the gaming, cryptocurrency and professional markets, as well as its system on a chip units (SoCs) for the mobile computing and automotive market.

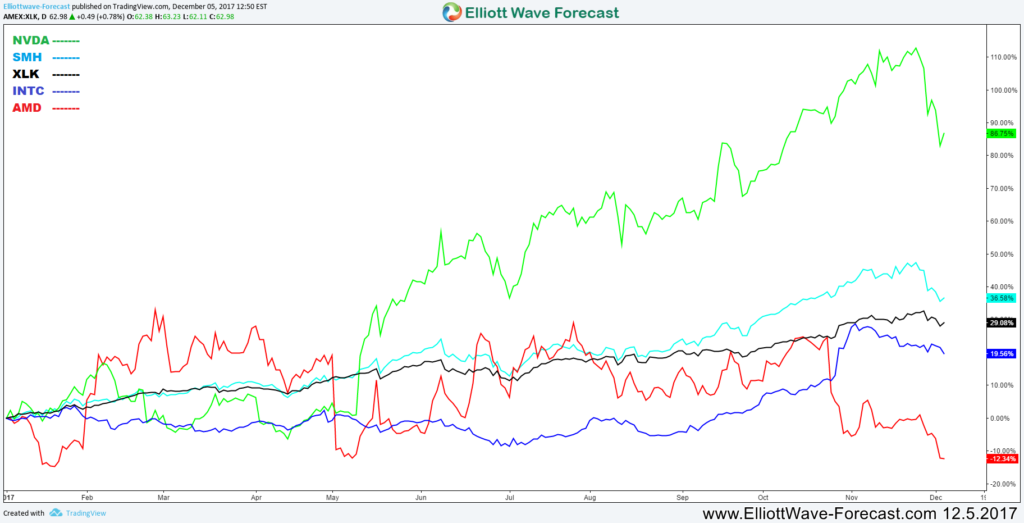

Nvidia is considered as one of the strongest technology companies this year and its stock NVDA enjoyed a great rally this year despite the recent 15% pullback. If we compare NVDA performance for this year to its main competitors Intel (NASDAQ:INTC) and Advanced Micro Devices (NASDAQ:AMD) then we can notice how strong the company has been this year, as well as outperforming both the Technology Select Sector SPDR ETF (NYSE:XLK), which is the best performer sector for 2017, and The VanEck Vectors Semiconductor ETF (NYSE:SMH), which contains the mega-cap semiconductors companies.

To understand the current situation for the Stock, we’ll explain the technical chart using Elliott Wave Theory and present 2 possible scenarios that could be taking place by the end of this year:

1st Scenario

In the chart above, we are presenting the cycle from July low as 5 waves ending diagonal structure which is still incomplete. The move is missing another leg higher toward extreme area $227 – $242 where the stock will be expected to end that cycle and start a 3 waves correction at least.

2nd Scenario

In the second chart, we are considering the cycle from July low completed as 7 swings double three structure after it reached equal legs area $211 – $229. Therefore the stock already started the correction lower with the first leg taking place during the recent decline. In this case, NVDA short term bounce is expected to fail below the recent $218 peak to be able to extend the correction lower toward the 50%-61.8% Fibonacci retracement of the rally around $156 – $142 area.

Conclusion

Nvidia short term analysis is suggesting a correction to take place either after making new all time highs or the pullback is already in progress. Consequently buyers need to be careful during the next period and it would be wise to wait for a clear corrective structure to take place before re-entering the long side.