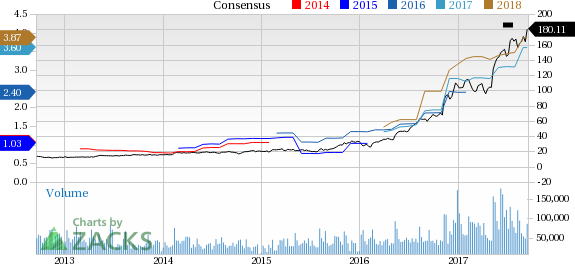

Share price of NVIDIA Corporation (NASDAQ:NVDA) rallied to a new 52-week high of $180.11, eventually closing at the same price on Sep 15. The stock has rallied 68.8% year to date, substantially outperforming the 22.1% gain of the industry it belongs to.

Also, we note that the company has beaten the Zacks Consensus Estimate in all the trailing four quarters, delivering an average positive surprise of 34.54%.

Notably, the Zacks Consensus Estimate for fiscal third-quarter 2018 has increased 20.5% to 94 cents over the last 60 days. For fiscal 2018, estimates increased 17.3% to $3.6 per share over the same time frame.

What’s Backing the Rally?

NVIDIA’s performance is primarily attributable to growth across all the four platforms, namely the GPUs gaming platform, Professional Visualization, datacenter and Tegra automotive platforms. The company’s innovative product pipeline and strength in gaming and high-end notebook GPUs keep it well positioned. We also believe that the higher adoption of NVIDIA’s Tegra processors will act as a catalyst, going ahead.

Also, NVIDIA growing strength in the artificial intelligence (AI) space has positively impacted its results. The company’s efforts toward autonomous vehicle and the AI segment reflect its intention to be the largest player in the self-driving and machine learning arena too.

Notably, in the last reported quarter, the company entered into a number of AI partnerships with the likes of Baidu (NASDAQ:BIDU) , Foxconn, Inventec, Quanta, and Wistron. Demand for NVIDIA’s DGX AI supercomputer is also high as more organizations are keen on building AI-enabled applications.

Further, its focus on GRID platforms can increase GPU adoption in data centers, giving it an advantage against its competitors.

NVIDIA’s latest collaboration with Square (NYSE:SQ) Enix to unveil Final Fantasy XV Windows Edition for PC in Gamescom 2017 is aimed at bringing an enhanced gaming experience to PCs. This deal is a positive for NVIDIA, as it will help the company gain market share among gaming content developers. We believe that NVIDIA’s GameWorks suite of tools, which improve the visual effects of games, will help to generate additional demand for its graphics technology.

Notably, the company has a market cap of $108.1 billion.

Zacks Rank & Key Picks

NVIDIA sports a Zacks Rank #1 (Strong Buy).

Other key picks in the broader technology sector include Activision Blizzard (NASDAQ:ATVI) and Micron Technology (NASDAQ:MU) , both sporting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Activision Blizzard and Micron is currently projected to be 13.6% and 10%, respectively.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Baidu, Inc. (BIDU): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post