- US has slowed issuance of export licenses for AI chips, citing national security concerns.

- This could hurt chipmakers reliant on China, a key market for Nvidia.

- Nvidia stock tumbled after news, but analysts remain bullish despite potential headwinds.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

U.S. officials are slowing export license approvals for powerful AI accelerator chips from companies like Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD), citing national security concerns.

The move comes amid a broader review of artificial intelligence technology and could significantly impact chipmakers, particularly those heavily reliant on Chinese sales.

The review process lacks a clear timeline, raising uncertainty for chipmakers. Officials are particularly focused on bulk sales to countries like the United Arab Emirates and Saudi Arabia, potentially aiming to safeguard sensitive technology.

This development is especially problematic for Nvidia, which recently engaged in a fierce price war with Chinese tech giant Huawei in the AI chip market.

This is similar to what Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA) have been facing in the Chinese market of late.

The potential for US export restrictions, combined with growing competition from Huawei in the crucial Chinese market (representing 17% of Nvidia's revenue), could further pressure Nvidia's already declining revenues from China.

This concern was echoed during Nvidia's first-quarter earnings report, where executives noted a significant decline in data center revenue from China following the implementation of new export controls in October.

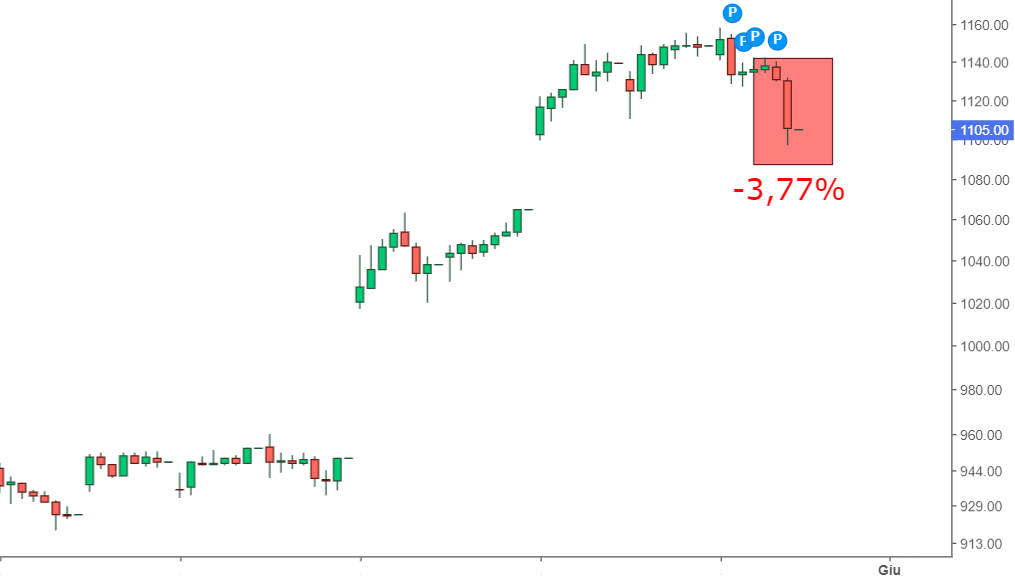

Nvidia's stock took a tumble, dropping over 3.5% after the news.

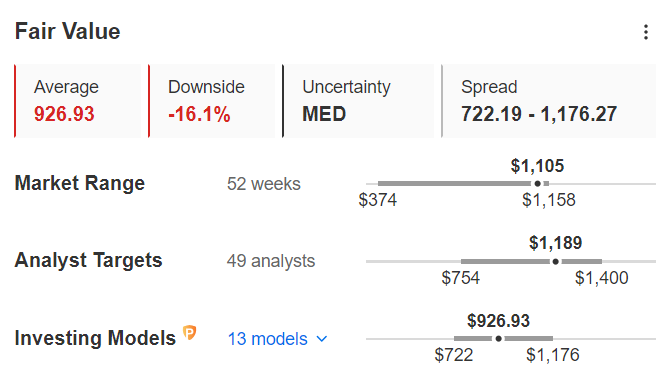

Here's a Look at Nvidia's Fair Value

InvestingPro calculates fair value using a combination of 13 financial models tailored to Nvidia's specific characteristics. Currently, their fair value sits at $926.93, a significant 16.1% below the current market price.

Source: InvestingPro

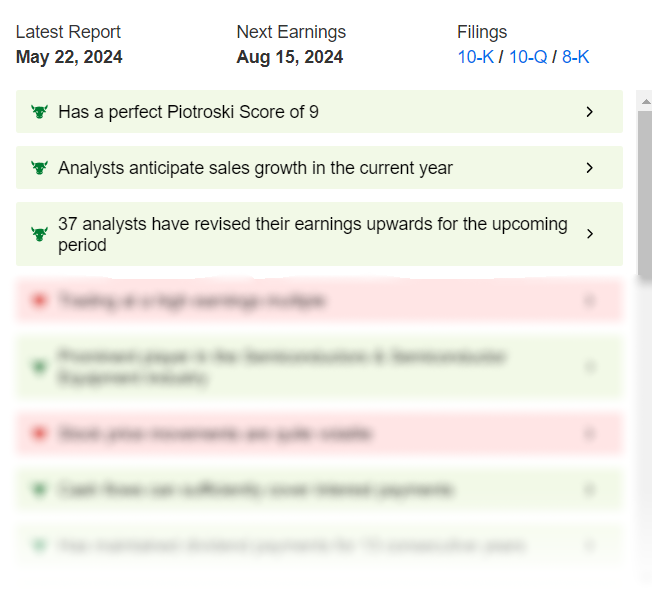

For InvestingPro subscribers, the platform offers valuable insights. Subscribers could track analyst forecast changes and see that, despite the recent stock price decline, analysts remain bullish with a target price of $1,189.

This suggests that analyst expectations for Nvidia's future earnings are growing faster than the stock price itself.

While the current price and fair value may indicate a potential overvaluation, Nvidia boasts an impressive risk profile. Its financial health scores a perfect 5 out of 5.

Potential Downside: Applying the average fair value as a downside target price on a chart suggests the stock could revisit its March 2024 highs.

Could this be an opportunity to buy the stock at lower levels? Only time will tell.

Using InvestingPro to Analyze the Stock

The following sections on InvestingPro provide a comprehensive analysis of Nvidia: fundamentals, financial health, competitor comparisons, financial statements (income statement, balance sheet, cash flow), earnings reports, exclusive news, historical valuations, and much more. This in-depth analysis culminates in a clear and informative company summary.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer:This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.