- Nvidia stock's correction seems to be coming to an end ahead of earnings later this month.

- Expectations are high for the report, and strong numbers could push the stock above all-time highs.

- The coming revenue and profit growth could be fueled by the projected growth of the entire AI-powered GPU industry.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Nvidia (NASDAQ:NVDA) has soared over the past year and a half, prompting questions about the rally's sustainability. While a recent correction shook the bulls' confidence, they have regained control recently.

This suggests the uptrend may continue, especially considering projected revenue and profit growth. The upcoming earnings report in the second half of the month could be a catalyst that sparks a new uptrend for the stock.

Will the Good Times Continue?

The market overwhelmingly expects Nvidia's revenue and earnings to continue their upward climb. Goldman Sachs confirms this bullish sentiment, raising their target price to $1,100 per share and maintaining a "buy" rating.

This optimism stems from factors like projected $110 billion in revenue by 2025 and anticipated 8% annual profit growth between 2025 and 2027.

The driving force behind these profits is the Data Center division, responsible for over half of Nvidia's revenue with its flagship Opper, Ampere, and Grace-Hopper accelerators.

Additionally, the company's strategic investment in Wayve Technologies, a UK-based autonomous car startup, demonstrates a commitment to diversifying revenue streams.

Further fueling the bullish sentiment is the projected growth of the entire AI-powered GPU industry to a staggering $800 billion by 2032.

Considering these factors, a sustained uptrend with a potential long-term break above the $1,000 psychological barrier seems highly likely.

Can Nvidia Continue to Report Impressive Earnings?

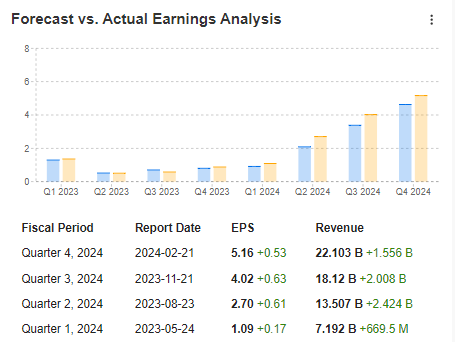

Looking at Nvidia's past year of quarterly results reveals a string of impressive growth, surpassing not only final results but also analyst expectations.

Source: InvestingPro

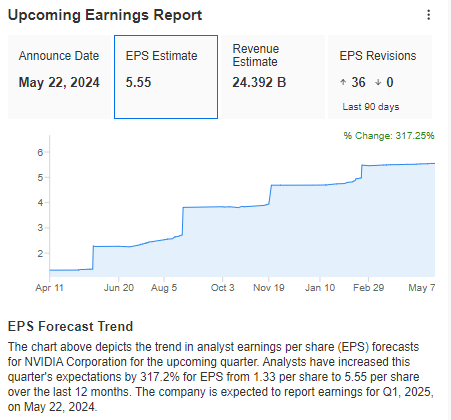

The outlook for Nvidia's stock is bullish, fueled by a wave of 36 upward revisions to analyst estimates.

Source: InvestingPro

However, investors should be cautious: inflated expectations for quarterly results can be a double-edged sword. Any disappointment could lead to a sharp selloff.

Technical View: Bulls Eye All-Time Highs

After recovering most of its April losses and resuming its upward climb in May, the primary target for buyers is a test of the historical highs just below $1,000.

But bullish ambitions extend beyond simply retesting the previous peak. They hope to achieve a sustained breakout above the psychological barrier of $1,000.

However, a break below the current upward trend line would negate this bullish scenario and potentially lead to a sideways movement in the stock price. This could trigger attempts to push the price back down towards the lows of the second half of April.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $10 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.