NVIDIA Corporation (NASDAQ:NVDA) reported earnings of $1.72 per share and revenue of $2.91 billion, both which beat expectations of $1.16 per share and $2.68 billion respectively.

The stock was up by 7% in Friday morning trading. The company attributed its earnings to strong demand related to computer gaming, artificial intelligence, and cryptocurrency mining.

With regard to crypto demand, our work suggests caution may be warranted, as the crypto surge may be an anomaly.

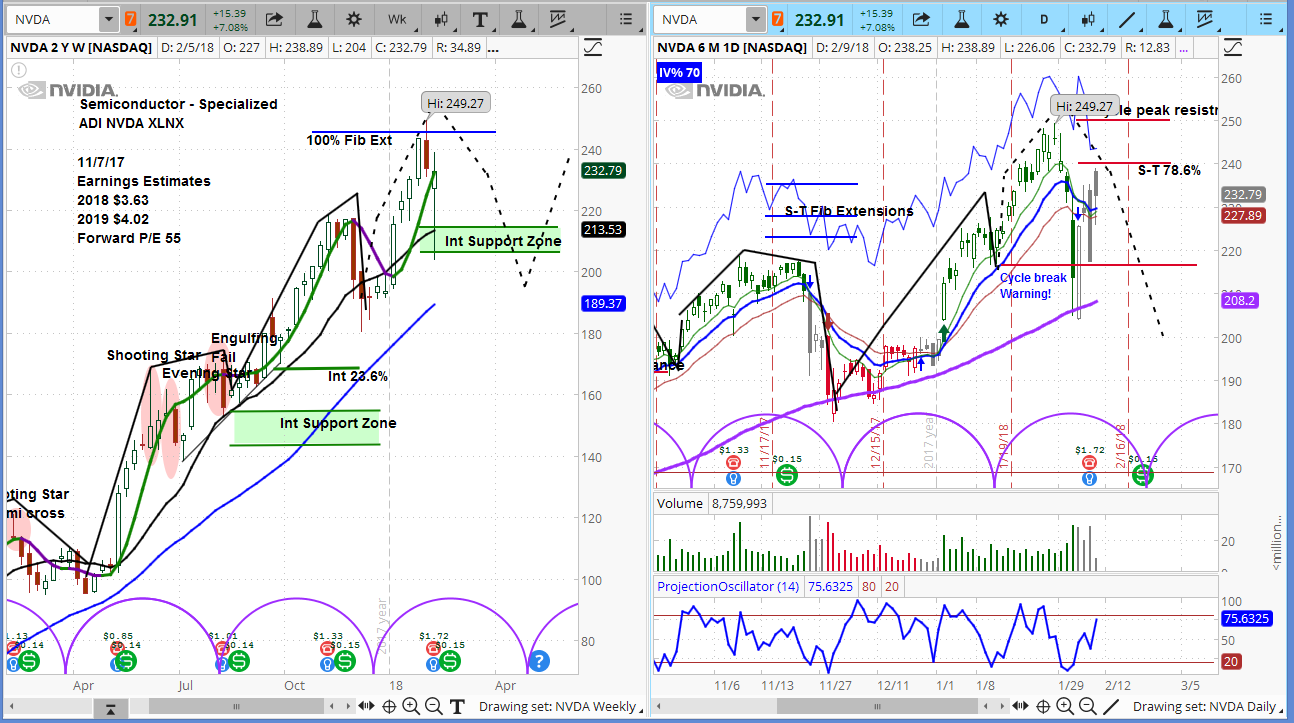

Considering our analysis on the weekly chart below, the current bounce came from support, however, the daily chart shows a breakdown.

It’s possible that NVDA could dip to $208 again, as the declining phase concludes its current intermediate market cycle.

The market cycles on the chart below are designated by the purple semicircles at the bottom of the chart.

NVDA Stock Chart (Weekly Bars)

Visit our site for more on our approach to using market cycles to analyze stocks.