What strikes me about the market right now is how NON-seriously people are taking the fiscal cliff. The assumption seems to be that there is a 100% chance that this thing is going to get solved just fine 'n' dandy, and not only that, but gee willikers, when an agreement is made, it's just going to be darned great for everybody.

Untrue. The digging-in-of-heels we are witnessing may continue for months, and when a deal does come through, it's going to suck out loud for a lot of people. Taxes will go up. Government "investments" (pfff!) will go down. And if they announce some kind of can-kicking "down-payment" miniature plan, I promise you, I'm going to throw up on live television.

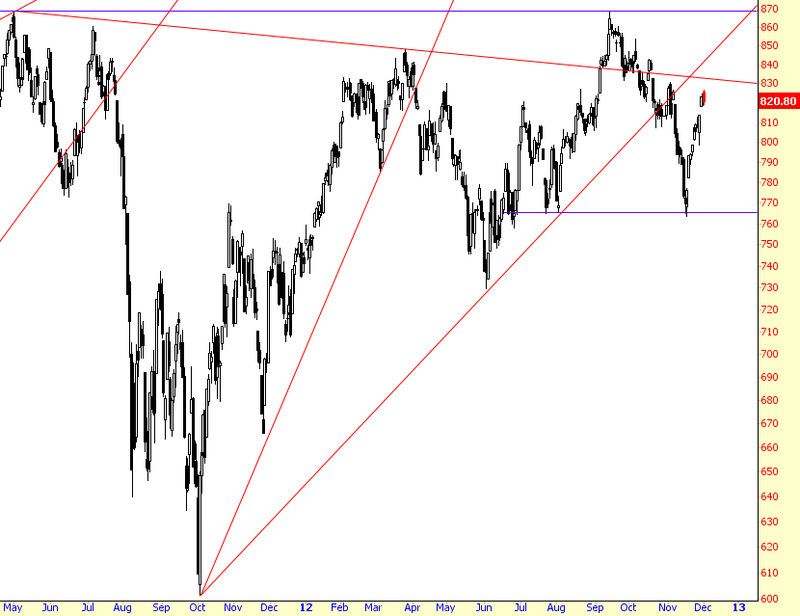

Looking at last year - - when we were trillions less in debt, and the politicians had a huge exit door to run through so that they didn't really have to reach an agreement - - the market actually seemed pretty sensible:

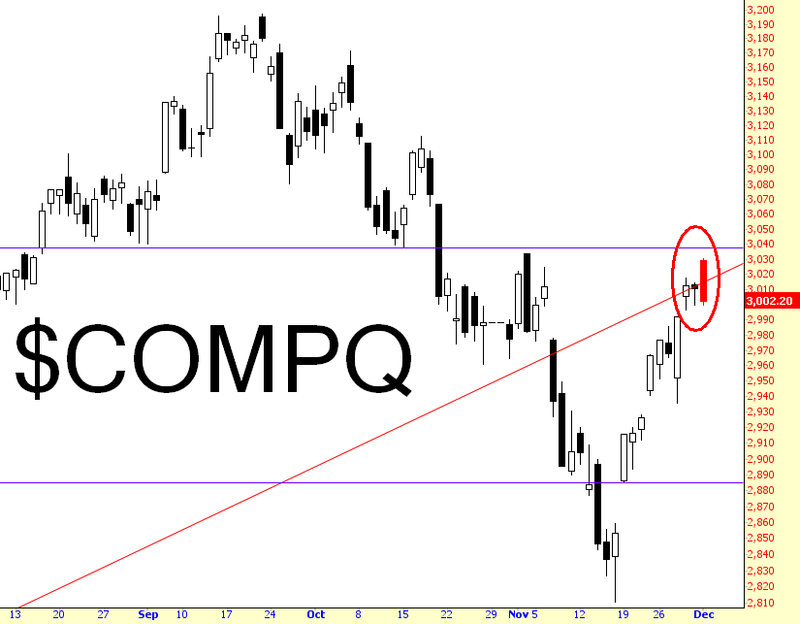

Today, though, we are only getting teeny little hints of weakness. Today's bearish engulfing pattern, seen on many indexes, is somewhat heartening.

The Russell 2000 was very strong during the absurd second-half-of-November bounce, but the trend lines suggest we're out of gas.

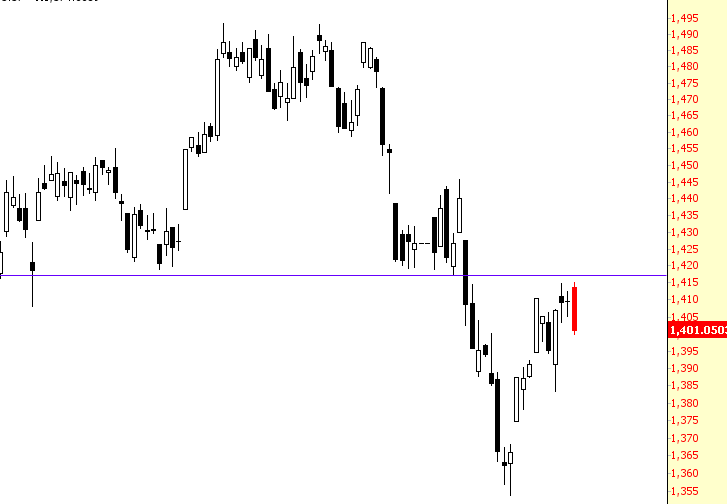

Some indexes are sporting pretty clean-looking H&S patterns, such as the NYSE Composite.

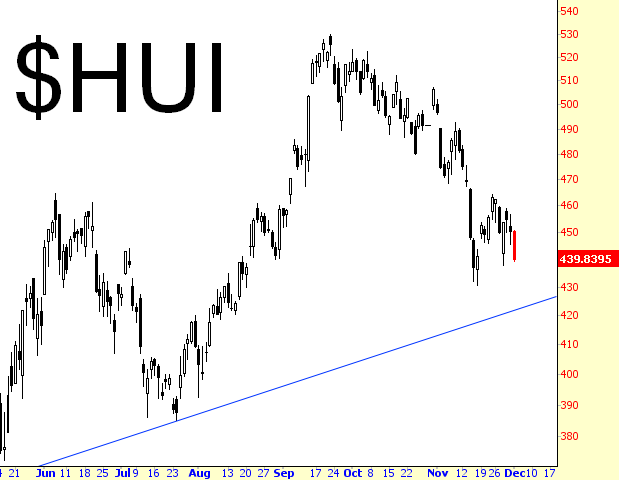

Miners in particular have been consistently weak the last few days, but the real fireworks will begin if we can break that trend line.

All I can say is...the analog below is one I'd really love to see pan out! It sure would make things easier on the downside.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Nutcracker Redux: The Realities Of the Fiscal Cliff

Published 12/04/2012, 02:54 AM

Updated 07/09/2023, 06:31 AM

Nutcracker Redux: The Realities Of the Fiscal Cliff

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.