Nutanix Inc. (NASDAQ:NTNX) recently partnered with Aviatrix to make private and public cloud infrastructure connectivity seamless.

The combined solution will provide enterprises a single pane for computing, storing and safe networking between hybrid cloud infrastructures, thereby making it easier for companies that use both private and public clouds.

We note that this deal will be beneficial for Nutanix, a provider of hyperconverged platform integrating server, storage, virtualization and networking. It will allow users of its recently announced Nutanix Calm multi-cloud orchestration software to extend their data centers to Microsoft’s (NASDAQ:MSFT) Azure, Amazon’s (NASDAQ:AMZN) AWS and other public cloud service providers.

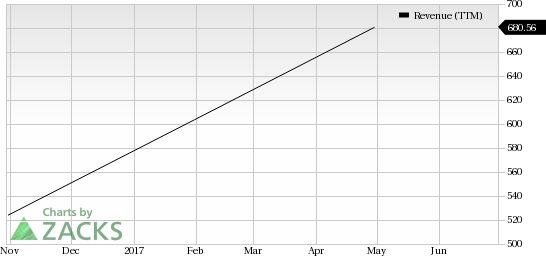

We believe partnerships like these and the one that Nutanix just entered into with Alphabet (NASDAQ:GOOGL) will increase the company’s customer base and eventually boost its top line. Notably, the company has underperformed the Zacks It Services industry on a year-to-date basis. While the industry gained 13.8%, the stock lost 25% over the same time period.

Growth Prospects of Hybrid Cloud Infrastructure

As the world moves toward flexible and cost effective storage and operations, the usage of hybrid cloud is increasing. It enhances the flexibility of computing as it can be scaled up per clients’ demand. Thus, the augmented version of private and public cloud can easily handle increased workload.

Per Gartner, by 2020, 90% of organizations will adopt hybrid infrastructure. Cloud compute services are expected to grow from $23.3 billion in 2016 to $68.4 billion in 2020. Hosting and collocation spending is also expected to surge to $74.5 billion in 2020 from $53.9 billion in 2016. Infrastructure Utility Service (IUS) is projected to grow from $21.3 billion in 2016 to $37 billion in 2020 and storage as a service will rise from $1.7 billion in 2016 to $2.7 billion in 2020.

How is Nutanix Placed in the Hybrid Cloud Sector?

We believe Nutanix is well placed given the growth prospects of this segment, post the collaboration with Alphabet. Per the partnership, Nutanix can move its applications from on-premises data centers to Google Cloud Platform.

Notably, the company’s own cloud solutions portfolio is also being upgraded with the launch of a new version of its Enterprise cloud OS. It features multicloud capabilities based on the automation platform provided by Calm.io, which Nutanix acquired last year. A new cloud service called Nutanix Xi Cloud Services has also been announced recently.

Thus, we expect the company to gain momentum on the back of the growth prospects offered by the sector and its own ability to make the most of them.

Zacks Rank

Currently, Nutanix carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Nutanix Inc. (NTNX): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research