Numis Corp (LON:NUM) made good progress across its business in FY17, started the current year at a similar pace and has a good pipeline of potential deals. Implementation of MiFID II will affect research and sales income, but the evidence so far points to a moderate rather than severe impact on this part of the business. Trading is subject to market trends but, given the strong start to the year and the further development of the firm’s franchise, we have raised both our estimates and valuation.

FY17 results

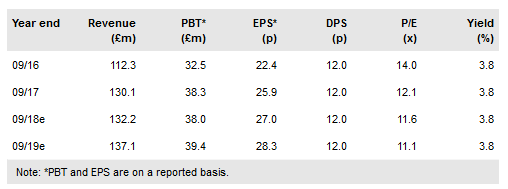

Revenues for FY17 were up 16%, with both Corporate Broking and Advisory (+15%) and Equities (+17%) contributing strongly. The number of corporate clients increased modestly, now standing at over 200, and their average market capital has increased by 33% to £728m. The median market cap is much lower at £322m and Numis remains committed to its small- and mid-cap stronghold. Equity raised for corporate clients increased by 33%. Within Equities, market-making revenue rose 39% and the strength of the research and sales team contributed to a 12% increase in institutional commissions in the face of continuing pressure on rates. Pre-tax profit rose by 18% to £38.1m and EPS by 15.6% to 25.9p. The dividend was unchanged at 12p and under a revised dividend policy the board intends to pay a stable dividend and return surplus liquidity through share buybacks (see page 4).

To read the entire report Please click on the pdf File Below: