I’m not the sharpest knife in the drawer, and sometimes it takes me years for a truth to sink through my thick skull. Allow me to give you a couple of examples.

The first has to do with buying gold bullion. Now, I’m not a gold kook, but I’m fond of coins and bullion to some degree, and there have been instances when I got the urge to buy the stuff. Usually this would come after a long bout of strength on gold’s part, and I just couldn’t help myself anymore, so I rushed out and gobbled up whatever I wanted at my local dealer.

Time after time, that would mark the top. Let me be clear, I’m not talking about buying GLD (NYSE:GLD) in my account. I’m talking about getting in my car, walking inside Pacific Precious Metals, and buying physical gold. And it never worked out.

I’m pleased to say that last week, I got the exact same urge, and at long, long last, I told myself, “Hey, Tim, the past 839 times you’ve done this have been a mistake. How about NOT doing this?” And so I stopped myself.

In fact, I went even farther than that, and on Thursday I wrote a bearish post to my beloved PLUS readers called Watching Miners, in which I touted the symbol JDST (that I bought) which is triple-bearish on junior miners. Just a couple of trading days later, it’s sporting a nice profit, and I don’t have any freakin’ GOLD from my dealer which has lost value. So – – hurray for me for finally learning!

I’m not quite there with crude oil, but I’m getting close. The problem here isn’t me personally. I don’t get the urge to rush out and buy barrels of oil. The problem has more to do with – – you guessed it – – commodity king Dennis Gartman.

The rule for me and gold is – – if I feel like buying bullion, I should short gold. I’ve finally learned that. The rule for me and oil SHOULD be – – do the opposite of whatever Dennis is doing. I have PARTLY learned that rule.

On June 23, Gartman declared that oil would be heading “egregiously lower”. To my credit, I started covering some of my oil positions and, when stopped out of DRIP, didn’t get back in. I didn’t enter any new positions in energy, and I’ve had no quarrel getting stopped out since then. So I *partly* did the right thing. Of course, the truly right thing would have been to dump everything instantly and bought ERX instead. So I only get half credit.

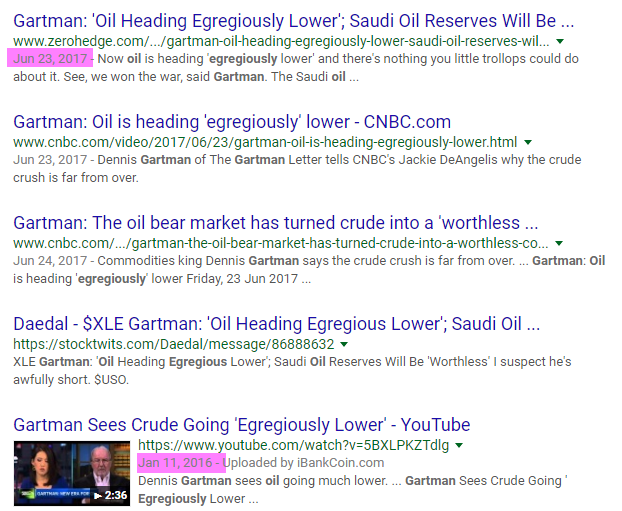

When I sought to talk about this, I did a Google search on “Gartman egregious oil” and was surprised to see this…………

There are various June 23 references, but check out the highlighted one – – it’s from January 11 2016. The EXACT same phrase! Does this guy need a thesaurus or something?

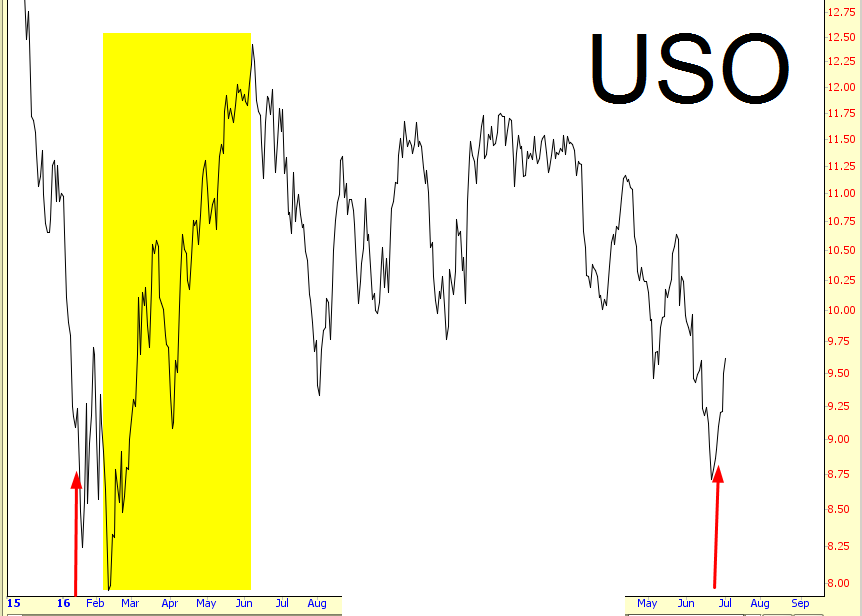

So I decided to plot out these two instances he used this phrase. In Dennis’ defense, the oil market did go a LITTLE lower after January 11th, but as you can see from the tinted area, his declaration preceded one of the largest rallies in recent memory. The arrows, I hope you’ve gathered by now, marked the points where he made his “egregious” declarations.

God forbid we get a rally as long-lasting as the last one!

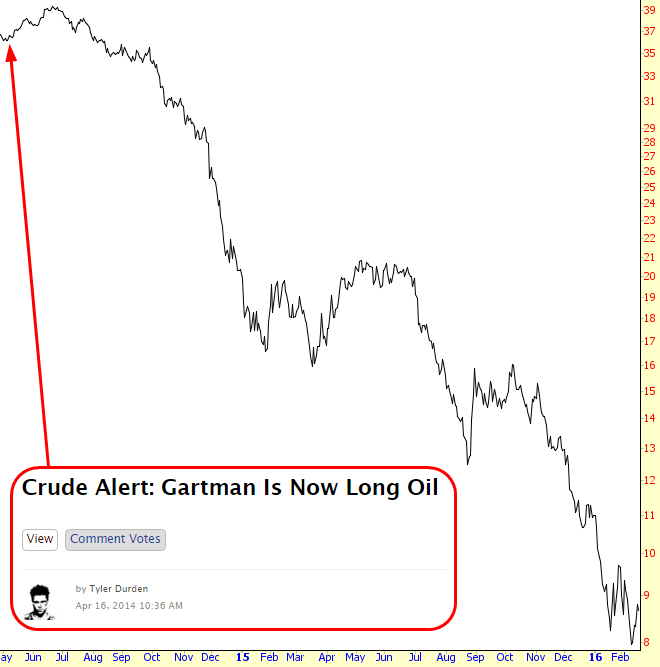

I did a few moments of poking around and saw another story from April 2014 in which, having suffered through a major rally while being short, Dennis finally flipped and jumped onto the long side. What happened next?

We see once again that he wasn’t PRECISELY at the inflection point, but boy, was he close. (Although I’m not the only one who has realized this contra-phenomenon).

My point is that I still haven’t trained myself to OBEY the signal, but I’m partly there. Some day I’ll make it 100%, just as I’ve done with gold. As of now, Gartman has re-asserted his oil bearishness, but God willing, he’ll throw in the towel around $50 and give me a chance to short again.