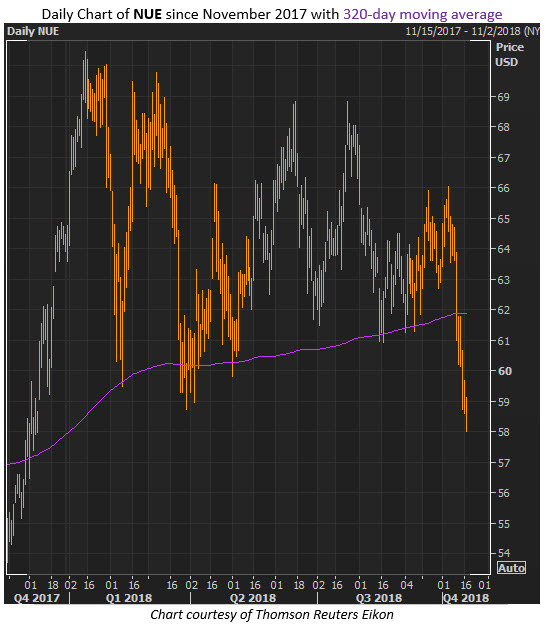

Nucor Corporation (NYSE:NUE) reports earnings before the open tomorrow, Oct. 18, and the stock has been selling off ahead of the event. NUE shares were last seen down 0.6% at $58.62, setting them up for the lowest close of 2018. The equity fell through long-term support at the 320-day moving average earlier this month, and recent earnings history says more downside is coming.

The stock has traded lower the day after earnings in three straight quarters, meaning the last time Wall Street responded favorably to a quarterly report from the steel company was this time last year. Overall, NUE hasn't made too many huge post-earnings moves in either direction in recent years, averaging just a 2.2% next-day swing, going back eight quarters. This time around, however, the options market is pricing in a 4.9% move for Thursday's session.

As for the sentiment backdrop, analysts are very bullish on Nucor. There are 10 brokerage firms covering the equity, and eight of them have "strong buy" recommendations. The average 12-month price target stands all the way up at $76.93.

In the options pits, however, traders have seemingly been more bearish. Take NUE's 10-day put/call volume ratio of 1.66 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). Not only does this show that put buying was much more popular than call buying, but it ranks in the 94th annual percentile, showing such preference for long calls is rare.