Nucor Corporation (NYSE:NUE) saw its profits surge year over year in the second quarter of 2017, but its earnings and sales fell short of expectations.

The steel giant logged a profit of $323 million or $1.00 per share for the second quarter, compared to earnings of $243.6 million or 76 cents per share it registered a year ago. Earnings per share for the reported quarter, however, trailed the Zacks Consensus Estimate of $1.07.

Revenues climbed around 22% year over year to $5,174.8 million in the reported quarter, but missed the Zacks Consensus Estimate of $5,307.8 million.

Operating Stats

Total steel mills shipments in the second quarter were 6,347,000 tons, up 7% year over year. Total tons shipped to outside customers were up 5% year over year to 6,748,000 tons. Average sales price in the quarter were up 17% year over year.

Steel mill operating rates rose to 90% in the reported quarter from 89% a year ago.

Segment Highlights

Nucor witnessed decreased profitability in its Steel Mills segment, especially bar mills and sheet mills, in the second quarter compared with the previous quarter, hurt by challenging market conditions for hot-rolled sheet products. The performance of plate mills improved on sequential basis.

The performance of Nucor’s Raw Materials segment in the second quarter improved compared with the first due to improved performance of its direct reduced iron (“DRI”) facilities.

Nucor also witnessed improved profitability in its downstream products segment on a sequential comparison basis in the second quarter.

Financial Position

Nucor ended the quarter with cash and cash equivalents of around $1,511 million, down roughly 15.2% year over year. Long-term debt was $3,240.7 million, down around 25.3% year over year.

Outlook

Moving ahead, Nucor expects earnings in third-quarter 2017 to be in a band similar to the quarterly results of first-half 2017. The company continues to achieve greater penetration of the automotive market and expects to continue this trend for the remaining year. Nucor is also upbeat about improving prospects in the energy markets.

Nucor, in May, announced plans to invest about $176 million to build a hot band galvanizing and pickling line at its sheet mill in Ghent, Kentucky that will serve its objective of growing share in the automotive market. The project is likely to expand the annual production capabilities of Nucor Steel Gallatin products. The project is expected to be completed in two years, subject to necessary approvals.

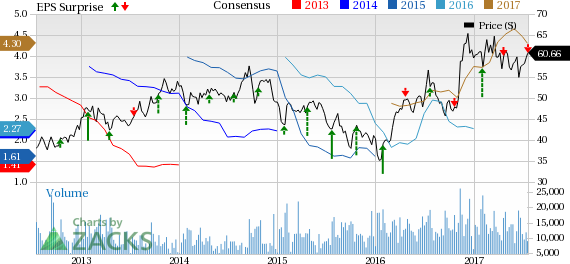

Price Performance

Nucor has underperformed the Zacks categorized Steel-Producers industry over the past three months. The company's shares declined around 1.3% over this period against the industry’s gain of 9.2%.

Nucor currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies in the basic materials space are The Sherwin-Williams Company (NYSE:SHW) , Ternium S.A. (NYSE:TX) and Hitachi Chemical Company, Ltd. HCHMY. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Ternium has expected long-term earnings growth rate of 18.4%.

Hitachi Chemical has expected long-term earnings growth rate of 5%.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

Nucor Corporation (NUE): Free Stock Analysis Report

Ternium S.A. (TX): Free Stock Analysis Report

HITACHI CHEMICL (HCHMY): Free Stock Analysis Report

Original post

Zacks Investment Research