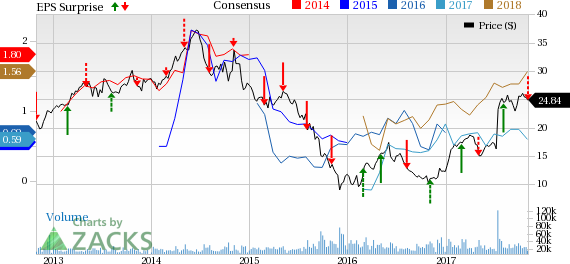

NRG Energy, Inc. (NYSE:NRG) reported earnings of 61 cents in the third quarter of 2017, lagging the Zacks Consensus Estimate 92 cents by 33.7%.

Revenues

NRG Energy's quarterly operating revenues of $3,049 million beat the Zacks Consensus Estimate of $2,937 million by 3.8%. However, revenues were down 10.9% from $3,421 million reported in the third quarter of 2016.

Highlights of the Release

Total operating costs and expenses in the quarter decreased 11.8% to $2,687 million from $3,045 million a year ago.

The company’s operating income was $376 million, down 12.1% from $428 million a year ago.

The company incurred interest expenses of $221 million in the quarter, down 6.7% from $237 million in the year-ago quarter.

Thanks to Transformation Plan, NRG Energy has realized $92 million cost savings in the third quarter and expects to save more in the future.

Financial Highlights

As of Sep 30, NRG Energy had cash and cash equivalents of $1,223 million compared with $938 million as of Dec 31, 2016.

The company’s long-term debt and capital leases (excluding current portion) were $15,658 million compared with $15,957 million as of Dec 31, 2016.

The company’s net cash provided in operating activities in the first nine months of 2017 was $844 million compared with $1,674 million in the prior-year period.

Capital expenditure in first nine months of 2017 was $760 million, up 15.3% from $659 million in the year-ago period.

Guidance

NRG Energy narrowed its 2017 adjusted EBITDA guidance in the range of $2,400-$2,500 from $2,565-$2,765 million. The company also lowered free cash flow before growth investments to a range of $1,175-$1,275 million from $1,290-$1,490 million.

NRG Energy projects 2018 adjusted EBITDA guidance in the range of $2,800-$3,000 million and free cash flow before growth investments in a range of $1,550-$1,750 million.

Zacks Rank

NRG Energy has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

NextEra Energy, Inc. (NYSE:NEE) reported third-quarter 2017 adjusted earnings of $1.85 per share, beating the Zacks Consensus Estimate of $1.75 by 5.7%.

Eversource Energy (NYSE:ES) reported third-quarter 2017 operating earnings of 82 cents per share, lagging the Zacks Consensus Estimate of 84 cents by 2.4%.

First Energy Corp. (NYSE:FE) reported third-quarter 2017 operating earnings of 97 cents per share, beating the Zacks Consensus Estimate of 86 cents by 12.8%

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

NRG Energy, Inc. (NRG): Free Stock Analysis Report

Eversource Energy (ES): Free Stock Analysis Report

Original post