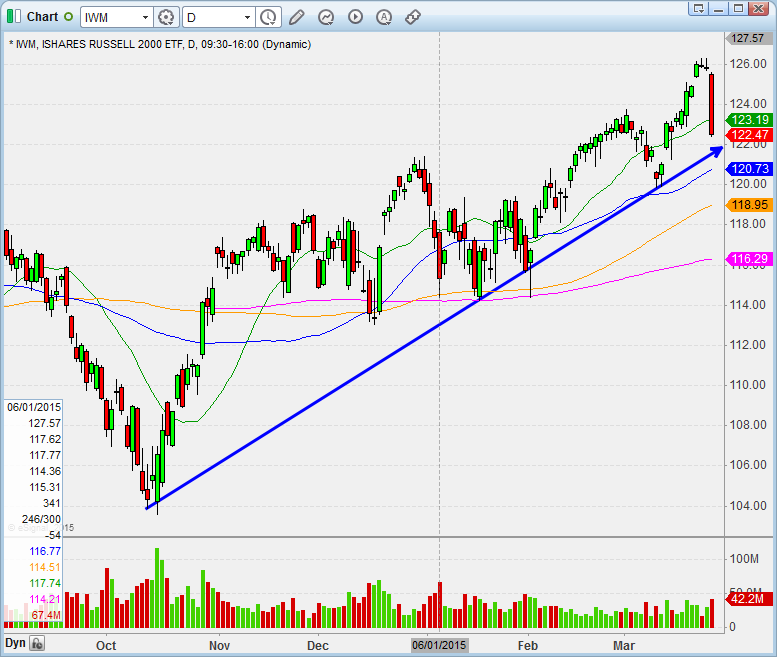

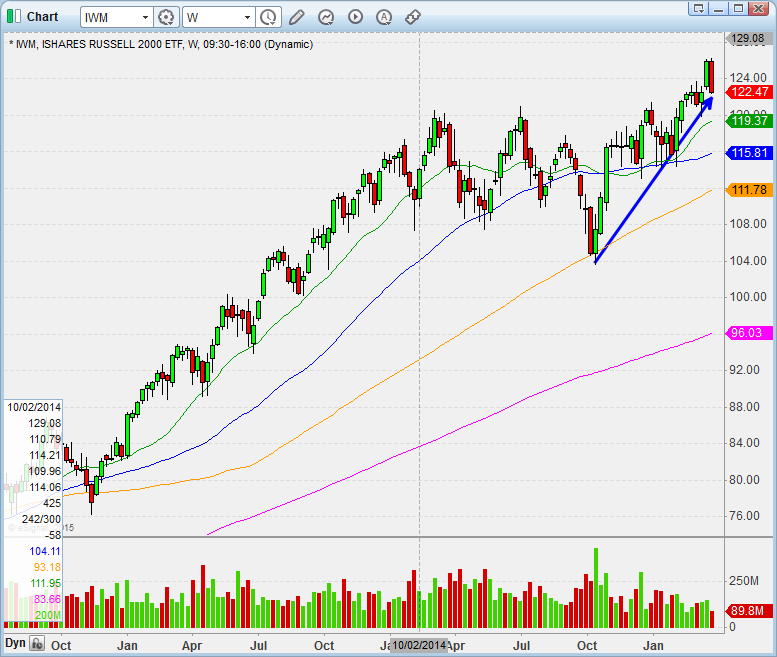

So where are we at? Well on Friday the iShares Russell 2000 Index (ARCA:IWM) closed above daily and WEEKLY upper Bollinger Bands®. We posted this on Sunday.

Above upper BB there are often only two choices: digestion or reversal. But rarely is it the place for new entries. Market pulled back and had major follow through today. We like to focus on IWM here because it’s been the clear leader. The first short-term support coming up is the trend-line near 122.

We would like to emphasize “short-term”: as you can see on weekly, it’s not really that important for longer term trend, but if bulls want to keep recent momo alive, that’s what they have to defend.

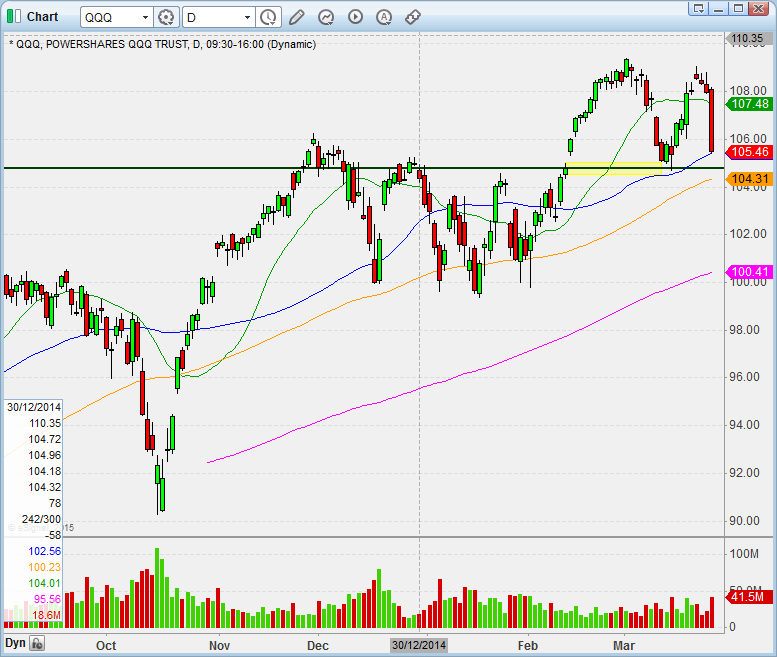

Along with the trend-line also keep an eye on PowerShares QQQ (NASDAQ:QQQ)104.5-105 — that was our first support test (from our first blog post this year!) and we said we would buy the first test. This would now be considered the second test. If that goes (roughly equivalent to SPY 204) then things can get murky fast.

Another good tell to keep an eye on is the tranny index (ARCA:IYT). The whole sector is on support right now — watch to see if bulls can keep things alive here next few days. (NYSE:UNP,) NYSE:FDX), (NYSE:CSX) all good for the watch-list. Volatility coming back — watch these major “tell” lines for clues on how serious bears are about this pullback.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.