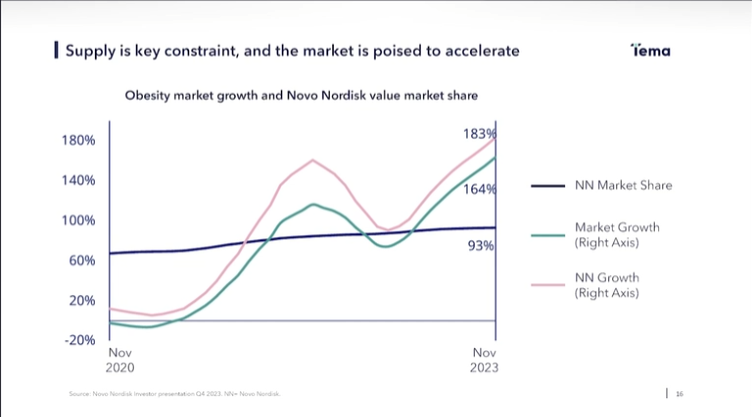

Obesity is rising and in the last 35 years, has more than doubled. The world population in 1999 to today is 42% or 22 million adults with a body mass index of 40 or higher.

Competition with Novo Nordisk (NYSE:NVO) is a factor, but analysts expect 20% or higher annual growth from the company for the next few years.

Earnings expectations for the company are $3.24 per share this year.

Novo-Nordisk (NVO) is an honorable mention pick in my Outlook 2025.

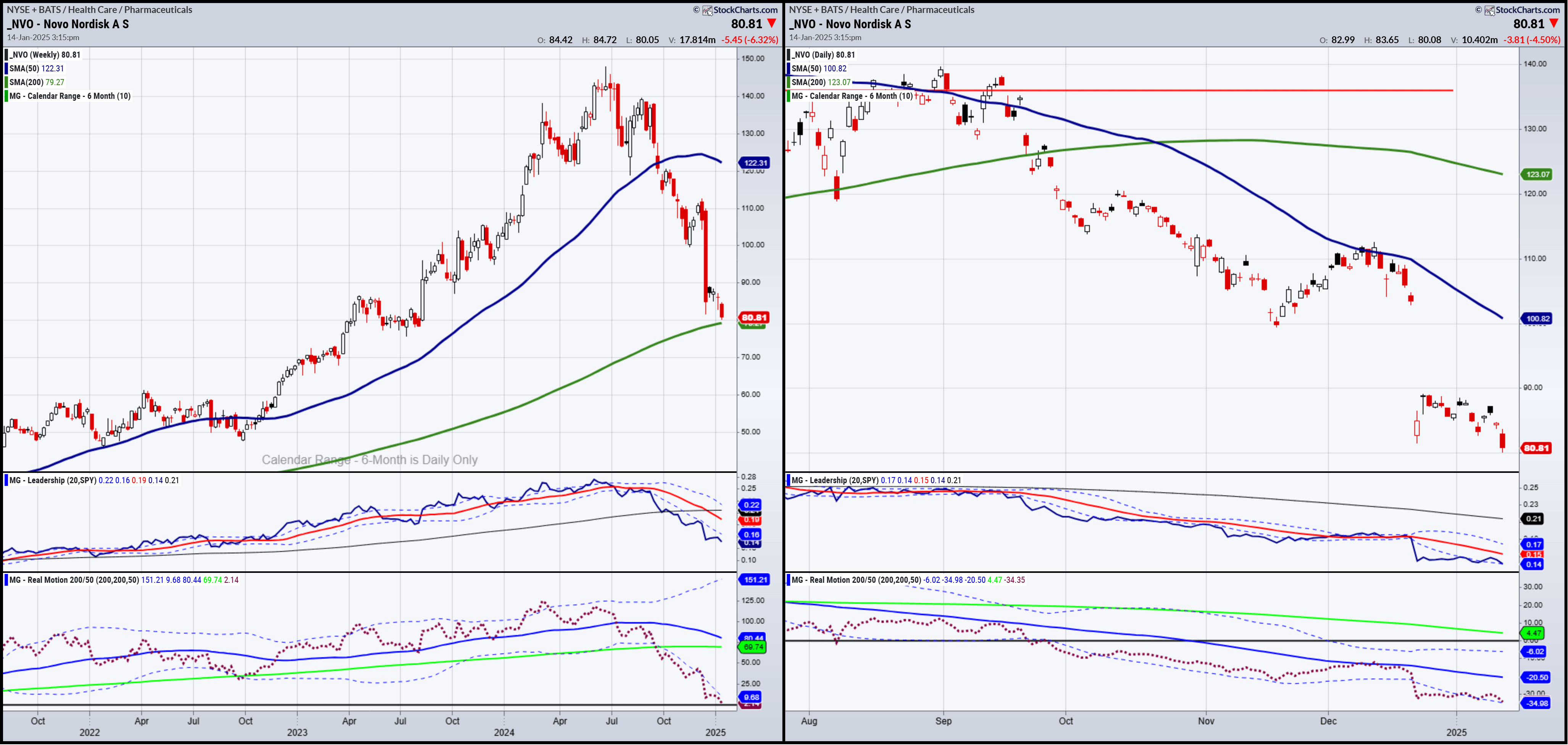

Now, from a technical standpoint, it looks not only way oversold (even on the monthly charts), but also now at major support levels.

What do we see in the charts?

On the weekly chart, NVO fell right down to the 200-week moving average. Clearly, the leadership is showing a gross lack of leadership.

Real Motion has yet to indicate a mean reversion, which is very interesting as the last one was in October 2022, right before the huge runup.

The Daily chart is less interesting than the weekly chart. Once again, zooming out is helpful, just as it has been in the Economic Modern Family.

Most notable on the Daily chart is that today we broke down under the low from December 20th and closed just shy of it.

That makes prior low pivotal.

As far as a trade, we will use the classic reversal pattern to determine entry with risk parameters.

My favorite investment is a solid company that falls to a major moving average, is oversold and then reverses on good volume.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) 580 now pivotal

- Russell 2000 (IWM) 215 now support 220 first resistance

- Dow (DIA) 421 support 430 resistance

- Nasdaq (QQQ) 500 key area to hold

- Regional banks (KRE) 60 cleared ahead of bank earnings-now must hold

- Semiconductors (SMH) 237 major support 250 resistance

- Transportation (IYT) While under resistance at 70, still holding-watch this

- Biotechnology (IBB) its 130 or bust

- Retail (XRT) Has to hold around 76

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 78.00 key area to hold