The ETFReplay.com Portfolio holdings have been updated for November 2014. I previously detailed here and here how an investor can use ETFReplay.com to screen for best performing ETFs based on momentum and volatility.

The portfolio begins with a static basket of 15 ETFs. These 15 ETFs are ranked by 6 month total returns (weighted 40%), 3 month total returns (weighted 30%) and 3 month price volatility (weighted 30%). The top 4 are purchased at the beginning of each month. When a holding drops out of the top 5 ETFs it will be sold and replaced with the next highest ranked ETF.

In addition, ETFs must be ranked above the cash ETF (ARCA:SHY) in order to be included in the portfolio, similar to the absolute momentum strategy I profiled here. This modification could help reduce draw-downs during periods of high volatility and/or negative market conditions (see 2008-2009), but it could also reduce total returns by allocating to cash in lieu of an asset class.

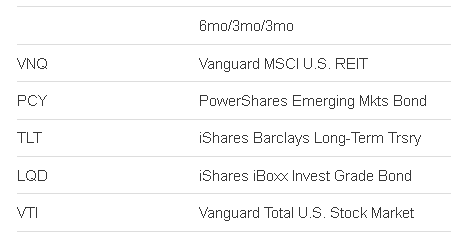

The top 5 ranked ETFs based on the 6/3/3 system as of 10/31/14 are below:

The portfolio maintains positions all of its current positions for November: (ARCA:TLT), (NYSE:PCY), (ARCA:LQD) and (ARCA:VTI).

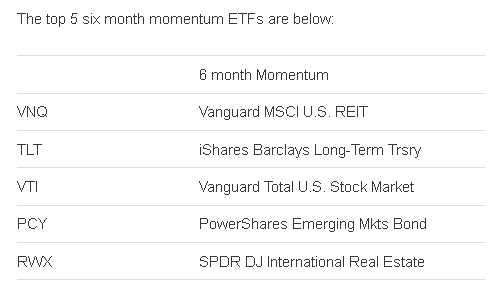

Beginning in 2014 we track both the 6/3/3 strategy (same system as 2013) as well as the pure momentum system, which will rank the same basket of 15 ETFs based solely on 6 month price momentum. There is no cash filter in the pure momentum system, volatility ranking, or requirement to limit turnover – the top 4 ETFs based on price momentum will be purchased each month. The portfolio and rankings will be posted on the same spreadsheet as the 6/3/3 strategy.

The 6 month momentum system maintains all of its current positions for November: (ARCA:TLT), (NYSE:PCY), (ARCA:VTI) and (ARCA:VNQ).