Novartis AG (NYSE:NVS) initiated a head-to-head trial, SURPASS, on psoriasis drug, Cosentyx. The drug will be compared to its proposed biosimilar for the treatment of ankylosing spondylitis (AS).

The trial is the first head-to-head clinical trial in AS investigating superiority of Cosentyx in slowing spinal bone damage compared with proposed biosimilar adalimumab.

We note that SURPASS and EXCEED are part of a larger rheumatology program for Cosentyx. In the head-to-head EXCEED trial, Cosentyx is being compared to AbbVie, Inc.’s (NYSE:ABBV) Humira in psoriatic arthritis (PsA). This trial is currently recruiting patients.

The trial is the first large double-blinded head-to-head clinical trial versus Humira in PsA investigating superiority of Cosentyx on ACR 20 at 52 weeks as the primary endpoint.

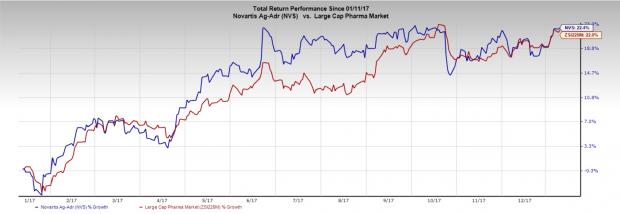

Novartis’ stock have rallied 22.4% over a year compared with the industry’s 22% gain.

Cosentyx is the first targeted biologic that specifically inhibits IL-17A, cornerstone cytokine involved in the inflammation of entheses in spondyloarthritis, which plays a major role in PsA and AS.

The drug was approved for the treatment of active AS and PsA. The drug was approved for the treatment of moderate-to-severe plaque psoriasis.

The uptake of Cosentyx has been strong and the company has grabbed market shares from rivals, Humira and and Amgen, Inc.‘s (NASDAQ:AMGN) Enbrel. Cosentyx achieved blockbuster status in 2016 recording over $1 billion of sales. Novartis expects $2 billion of sales from Cosentyx in 2017.

We note that Novartis has a strong oncology portfolio. The company’s breast cancer portfolio includes drugs like Afinitor, Kisqali and Tykerb. Approval of new drugs and label expansion of existing drugs will further enhance its portfolio.

In March 2015, Novartis acquired certain oncology products and pipeline compounds from GlaxoSmithKline plc (NYSE:GSK) for $16 billion. In exchange, the company sold its non-influenza Vaccines business to Glaxo for $7.1 billion.

Meanwhile, Sandoz, the generic arm of Novartis, continues to advance its portfolio of biosimilars and generics.

Zacks Rank

Novartis currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Novartis AG (NVS): Free Stock Analysis Report

GlaxoSmithKline PLC (GSK): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Original post