Novartis AG’s (NYSE:NVS) generic arm, Sandoz, reported data from four clinical studies. The studies compared proposed biosimilar adalimumab and biosimilar rituximab to reference drugs, AbbVie, Inc.’s (NYSE:ABBV) Humira and Roche Holdings (OTC:RHHBY) MabThera respectively.

The studies included two innovative trials involving switching and two pharmacokinetic (PK) and pharmacodynamic (PD) studies.

A phase III confirmatory efficacy and safety study met its primary endpoint in the proportion of patients who achieved a 75% improvement at week 16. The study confirmed that there were no meaningful clinical differences in efficacy, safety and immunogenicity in patients who continuously received adalimumab, those who continuously received the reference drug and those who switched between biosimilar adalimumab and reference drug on multiple occasion.

In addition, a phase III study evaluated rituximab retreatment in patients with rheumatoid arthritis (RA), who had already received reference rituximab for treatment of RA in the past. The study evaluated the biosimilar and the reference drug in terms of safety and immunogenicity in patients who switched from the reference drug to biosimilar rituximab and in those who continued treatment with the reference drug.

In addition, the PK and PD data demonstrated equivalence as the phase I PK study met its primary endpoint as bioequivalence was demonstrated between the biosimilar adalimumab and the reference drug.

We note Sandoz holds a leading position in the biosimilars space with a portfolio of five marketed biosimilars currently and a deep pipeline.

The biosimilar version of rituximab, Rixathon, was approved by the European Commission in June 2017. It is currently under review in the United States. The biosimilar version of Humira is also under review in the EU.

Meanwhile, Sandoz witnessed strong growth outside the United States buoyed by biosimilar launches of Rixathon and Erelzi, the biosimilar of Amgen, Inc.’s (NASDAQ:AMGN) Enbrel in Europe. However, pricing pressure intensified in the United States. The company expects low single-digit sales decline at Sandoz in the fourth quarter, mainly due to seasonal shipment phasing and continued pricing pressures in the United States.

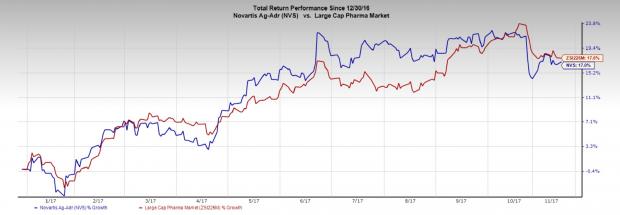

Novartis’ stock has rallied 17% year to date compared with the industry’s 17.6% gain. In the first half of 2017, Novartis announced that it is mulling strategic options for Alcon which includes retaining the business separation via capital market transactions such as a spin-off or an initial public offering. The company believes that the Alcon division has revived and hence a decision on a possible spin-off will be taken in 2019. The recent approvals of Kymriah and Kisqali will further boost the oncology portfolio and drive growth.

Zacks Rank

Novartis currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Original post