Novartis (NYSE:NVS) announced that its eye-care unit, Alcon acquired privately-held, U.S.-based medical device development company, PowerVision, Inc.

Per the terms, Alcon paid $285 million to PowerVision at closing, with additional payments based on specified regulatory and commercial milestones starting 2023.

PowerVision develops fluid-based accommodating intraocular lenses for cataract surgery patients.

The acquisition will advance Alcon's commitment toward driving growth and innovation in advanced technology intraocular lenses (AT-IOLS) for cataract surgery patients.

Last month, Novartis’ shareholders approved the proposed 100% spin-off of the Alcon eye-care division. The spin-off is expected to be completed in the second quarter of 2019.

The spin-off will be completed through the distribution of a dividend-in-kind of new Alcon shares to Novartis’ shareholders and ADR (American Depositary Receipt) holders.

The last year was a transformative year for Novartis, as it restructured its business to focus on becoming a core drug-focused company, powered by data and digital technologies.

In September 2018, Novartis announced that it agreed to sell selected portions of its Sandoz U.S. portfolio, specifically the Sandoz U.S. dermatology business and the U.S. oral solids portfolio. The divestiture is in accordance with Sandoz’s strategy of focusing on complex generics, value-added medicines and biosimilars to achieve sustainable and profitable growth in the United States in the long run. The transaction will be completed in 2019.

Novartis also sold its stake in consumer healthcare joint venture to GlaxoSmithKline (NYSE:GSK) for $13 billion.

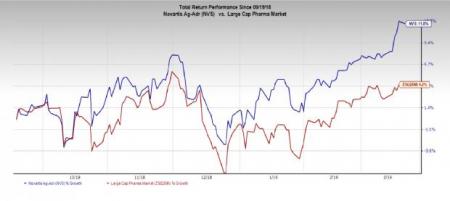

Novartis’ stock has gained 11.8% in the past six months compared with the industry's 4.2% growth.

The company is looking to solidify its presence in the gene-therapy space. It acquired U.S.-based clinical-stage gene-therapy company, AveXis, Inc. The company also acquired Endocyte to expand expertise in radiopharmaceuticals. We expect further acquisitions in the coming months as the company looks to further restructure its business.

Zacks Rank

Novartis currently carries a Zacks Rank #4 (Sell). A couple of better-ranked stocks in the healthcare sector are Bristol-Myers Squibb Company (NYSE:BMY) and AstraZeneca PLC (NYSE:AZN) . Both the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bristol-Myers’ earnings estimates have been revised 1% and 6.4% upward for 2019 and 2020, respectively, over the past 90 days.

AstraZeneca’s earnings estimates have been revised 1.7 % north for 2019 over the past 60 days.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

AstraZeneca PLC (AZN): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

GlaxoSmithKline plc (GSK): Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Original post

Zacks Investment Research