Novartis AG’s (NYSE:NVS) subsidiary, Advanced Accelerator Applications, obtained FDA approval for its new drug application (NDA) for Lutathera (lutetium Lu 177 dotatate) for the treatment of somatostatin receptor positive gastroenteropancreatic neuroendocrine tumors (GEP-NETs), including foregut, midgut and hindgut neuroendocrine tumors in adults.

We remind investors that last week, Novartis completed a successful tender offer for Advanced Accelerator Applications.

Lutathera is a first-in-class drug and the first available FDA approved Peptide Receptor Radionuclide Therapy, a form of treatment comprising a targeting molecule that carries a radioactive component. The approval was based on encouraging phase III study results which demonstrated a 79% reduction in the risk of disease progression or death within the Lutathera plus best standard of care arm (octreotide LAR 30mg every four weeks) compared to 60 mg of octreotide LAR alone (hazard ratio 0.21, 95% CI; 0.13-0.32; p

The approval of Luthera expands Novartis` neuroendocrine tumor portfolio.

Approval of new drugs boost Novartis’ portfolio which is facing generic competition for its blockbuster drug Gleevec.

Last week, Novartis reported encouraging results for the fourth quarter wherein results beat both earnings and sales estimates on strong performance of Cosentyx and Entresto. Psoriasis Cosentyx achieved multi-blockbuster drug status in 2017 on the back of strong growth of three approved indications while Entresto’s sales benefited from continued access improvements and expansion of sales force in the United States.

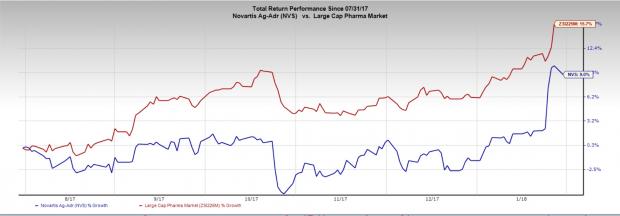

Novartis’ stock has rallied 9.0% in the last six months compared with the industry’s 15.7% gain.

The generic division, Sandoz also combatted pricing pressure strongly buoyed by launches of Rixathon, the biosimilar version of Roche Holdings’ (OTC:RHHBY) Rituxan (rituximab) and Erelzi, the biosimilar of Amgen.’s (NASDAQ:AMGN) Enbrel in EU. The proposed biosimilar version of AbbVie’s (NYSE:ABBV) Humira (adalimumab) has also been accepted for review by the FDA.

Meanwhile, the strategic decision on Alcon to retain the business or separation via capital market transactions such as a spin-off or an initial public offering has been postponed. The company believes that the Alcon division has revived well for now and hence a decision on a possible spin-off will be taken in 2019. The recent approvals of Kymriah and Kisqali will further boost the oncology portfolio and drive growth.

Zacks Rank

Novartis currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Original post

Zacks Investment Research