Novartis AG (NYSE:NVS) announced long-lasting skin clearance rates of Cosentyx in plaque psoriasis patients from a phase III study, which evaluated the drug for five years. Cosentyx is the first and only fully human IL-17A inhibitor to achieve sustained skin clearance rates over five years, reinforcing its long-term favorable impact.

Data from the study showed that Cosentyx maintained 100% Psoriasis Area and Severity Index (PASI) 90 and PASI 100, a measure of skin clearance, from year one to year five in patients with moderate-to-severe plaque psoriasis.

Data from this study were presented at the 26th European Academy of Dermatology and Venereology (EADV) Congress in Geneva, Switzerland.

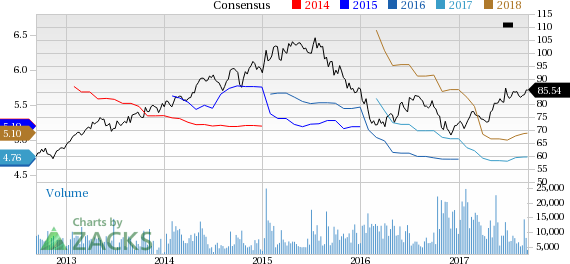

Shares of the company have outperformed the industry, having surged 17.4% so far this year, while the industry increased 16%.

The drug is approved in the United Sates for the treatment of adults with active ankylosing spondylitis, active psoriatic arthritis (PsA) and moderate-to-severe plaque psoriasis. Since its launch, the drug has been prescribed to more than 100,000 patients. Cosentyx achieved blockbuster status in 2016, recording $1.1 billion in sales. In first-half 2017, it generated solid sales of $900 million.

The long-term safety and efficacy data of the drug is expected to further boost its growth.

Meanwhile, in the second quarter, the drug was granted approval in Europe for a label update to include 52-week data from the CLEAR study. It demonstrated the long-term superiority of Cosentyx compared to Johnson & Johnson’s (NYSE:JNJ) Stelara in psoriasis. Also, patient recruitment is underway for the new head-to-head clinical trial, EXCEED, to evaluate the superiority of Cosentyx versus AbbVie’s (NYSE:ABBV) Humira in PsA.

Novartis expects the next growth phase to begin in 2018 driven by Cosentyx (in psoriasis, psoriatic arthritis and ankylosing spondylitis indications), Entresto, Kisqali and a deep pipeline with candidates like BAF312, AMG 334, RTH258. Moreover, the approval of Kymriah (CTL019) in August made Novartis the first company to bring CAR-T cell therapy to treat cancer. Going forward, we expect that the approval of new drugs and label expansion of existing ones to bode well for Novartis.

Zacks Rank & Stock to Consider

Novartis has a Zacks Rank #3 (Hold). Aduro Biotech, Inc. (NASDAQ:ADRO) is a better-ranked biomedical company with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aduro’s loss estimates narrowed 9.6% to $1.32 for 2017 and 20% to $1.24 for 2018 over the last 60 days. The company delivered an average earnings beat of 2.53% for the four trailing quarters.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Novartis AG (NVS): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research