Novartis AG (NYSE:NVS) announced that it has entered into clinical research collaboration with Bristol-Myers Squibb Company (NYSE:BMY) .

Per the terms of the agreement, Bristol-Myers will investigate the safety, tolerability, and efficacy of Novartis’s Mekinist in combination with its own Opdivo and Opdivo + Yervoy regimen as a potential treatment option for metastatic colorectal cancer in patients with microsatellite stable tumors where the tumors are proficient in mismatch repair (MSS mCRC pMMR).

The study will be conducted by Bristol Myers-Squibb. The study is expected to establish recommended dose regimens and the preliminary anti-tumor activity of the combination therapies.

Both the companies will determine the data from the study to determine optimal approaches and potential clinical development of these combinations.

We note that Novartis broadened its oncology portfolio by acquiring GlaxoSmithKline plc’s (NYSE:GSK) certain oncology products and pipeline compounds in Mar 2015 after having divested its Animal Health Division to Eli Lilly and Co. (NYSE:LLY) Mekinist was acquired from Glaxo.

We note that Opdivo became the first PD-1 inhibitor to be approved for a hematological malignancy – classic Hodgkin lymphoma in both the U.S. (May 2016) and the EU (Nov 2016). In Nov 2016, Opdivo gained the FDA approval for the treatment of patients with recurrent or metastatic squamous cell carcinoma of the head and neck with disease progression on or after platinum-based therapy. The FDA approved Opdivo for the treatment of patients with previously treated locally advanced or mUC in Feb 2017.

In Oct 2015, Bristol-Myers Squibb's Opdivo and Yervoy combination regimen became the first immuno-oncology combination to receive regulatory approval for the treatment of metastatic melanoma.

Bristol-Myers continues to evaluate Opdivo alone or in combination therapies with Yervoy and other anti-cancer agents. Label expansion into additional indications would give the product access to a higher patient population and increase the commercial potential of the drug significantly.

Approval of new drugs and label expansion of existing ones are likely to bode well for Novartis which is facing generic competition for key drugs.

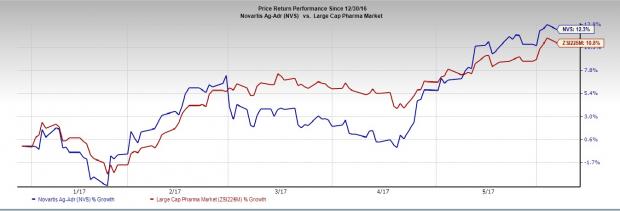

Novartis has outperformed the Zacks classified industry year to date. The stock has rallied 12.3% compared with the Large Cap Pharmaceuticals industry’s gain of 10.8%. On the other hand, Bristol-Myers’ share price decreased 110.2% in the last 12 months.

Zacks Rank

Novartis currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

GlaxoSmithKline PLC (GSK): Free Stock Analysis Report

Original post

Zacks Investment Research