While this headline likely gets filed under "I don't give two sh*ts about old news," it contains a lesson for those willing to press history's rewind button periodically. Yellen, a pure academic and probably a nice lady, has learned a lesson that Greenspan also learned the hard way nearly two decades ago - Don't comment on valuations, and if speaking is absolutely necessary, do so in a manner that confuses the hell out of everyone except those with ability to read between the lines. That's usually not the people asking the questions. Greenspan, the master of Fedspeak or Greenspeak, should have lunch with Yellen.

If Yellen thinks social media, biotech, and possibly stocks were beginning to defy gravity this summer (2014), frankly, she hasn't seen sh*t yet. Irrational exuberance, driven by a phase transition of energy, can drive 'valuations' and equity trends to unimaginable extremes.

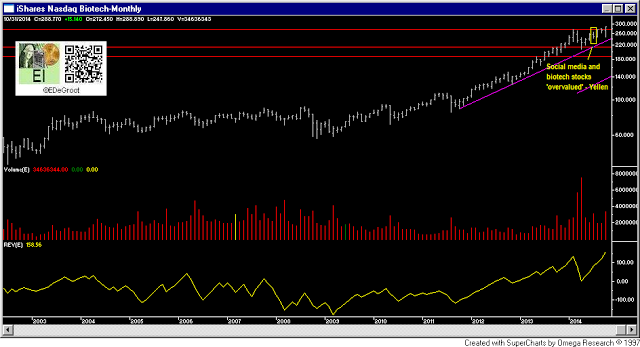

Biotechs despite a general stock market correction have broken out to new highs (chart).

Headline: YELLEN TAKES DEAD AIM AT SOCIAL-MEDIA COMPANY VALUATIONS

Federal Reserve Board Chair Janet Yellen is warning that social-media companies' share prices, and those of other high-flying stocks, are starting to defy gravity.

In her just-released full report to Congress on the state of monetary policy, the Fed chair says, "...Valuation metrics in some sectors do appear substantially stretched—particularly those for smaller firms in the social media and biotechnology industries, despite a notable downturn in equity prices for such firms early in the year."