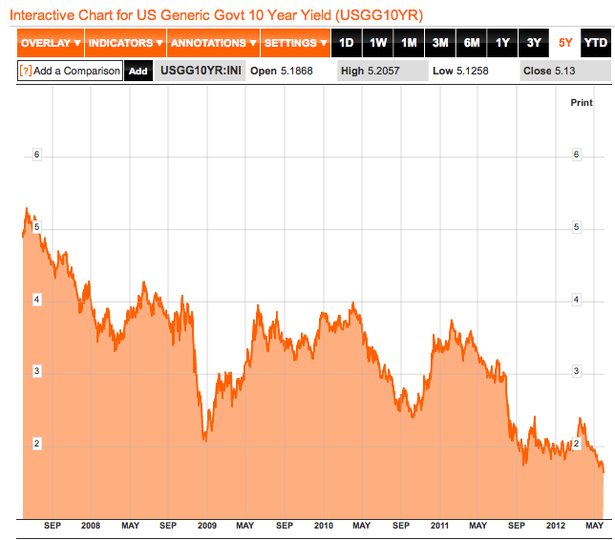

notes that 10-year Treasury bond yields have hit a 220-year low:

One of these days, the bond vigilantes will show up. Friday was not that day though. Monday's not looking good either.

The chart below from Bloomberg shows the nominal yield on 10-year Treasury bonds the past five years. Thursday's midday yield was the lowest it's been over that period. It was also the lowest it's been the past 50 years. Actually, 100 years. No, 220 years.

Yes, Thursday's brief sub-1.54 percent yield was the lowest ever.

I suppose most Wall Street "strategists" would say this means stocks are very cheap, since the S&P 500 index has an earnings yield -- earnings divided by price, or the reciprocal of the P/E ratio -- that is more than four times higher and a dividend yield that is 33 percent greater.

Then again, maybe the soaring bond market is telling us something more along the lines of what one successful investor has to say about our future prospects, as Zero Hedge reports in "'The End Game: 2012 And 2013 Will Usher In The End" - The Scariest Presentation Ever?":

If Raoul Pal was some doomsday spouting windbag, writing in all caps, arbitrarily pasting together disparate charts to create 200 page slideshows, it would be easy to ignore him. He isn't. The founder of Global Macro Investor "previously co-managed the GLG Global Macro Fund in London for GLG Partners, one of the largest hedge fund groups in the world. Raoul came to GLG from Goldman Sachs where he co-managed the hedge fund sales business in Equities and Equity Derivatives in Europe... Raoul Pal retired from managing client money in 2004 at the age of 36 and now lives on the Valencian coast of Spain, from where he writes." It is his writing we are concerned about, and specifically his latest presentation, which is, for lack of a better word, the most disturbing and scary forecast of the future of the world we have ever seen....

And we see a lot of those.

Consider this:

- We are here...

- We don’t know exactly what is to come, but we can all join the very few dots from where we are now, to the collapse of the first major bank…

- With very limited room for government bailouts, we can very easily join the next dots from the first bank closure to the collapse of the whole European banking system, and then to the bankruptcy of the governments themselves.

- There are almost no brakes in the system to stop this, and almost no one realises the seriousness of the situation.

- The problem is not Government debt per se. The real problem is that the $70 trillion in G10 debt is the collateral for $700 trillion in derivatives…

- Yes, that equates to 1200% of Global GDP and it rests on very, very weak foundations

- From an EU crisis, we only have to join one dot for a UK crisis of equal magnitude.

- And then do you think Japan and China would not be next?

- And then do you think the US would survive unscathed?

- That is the end of the fractional reserve banking system and of fiat money.

- It is the big RESET.

- Bonds will be stuck at 1% in the US, Germany, UK and Japan (for this phase).

- The whole bond market will be dead.

- Short selling on bonds - banned

- Short selling stocks – banned

- CDS – banned

- Short futures – banned

- Put options – banned

- All that is left is the Dollar and Gold

It only gets better. We use the term loosely:

- We have around 6 months left of trading in Western markets to protect ourselves or make enough money to offset future losses.

- Spend your time looking at the risks of custody, safekeeping, counterparty etc. Assume that no one and nothing is safe.

- After that…we put on our tin helmets and hide until the new system emerges

And the punchline

- From a timing perspective, I think 2012 and 2013 will usher in the end.

Wow. That's pretty scary, even to me.