We all know that Amazon (AMZN) is killing the hopes and dreams of many stocks in many sectors. Retail has easily been one of the hardest hit sectors. The stocks in that industry have been facing the wrath of Amazon for the last several years, but it is the tide about to turn?

Presidential tweets have put AMZN on blast and maybe now is the time to take a look at some competitors as money managers may look to move some assets from the retail leader to some other names in the space.

With this in mind, I checked to see the strongest retailing industry and I was surprised to see consumer electronics to be in the top 2% of all industries covered by the Zacks Industry Rank.

Pair of #1’s

I was surprised to see the name that everyone has been calling the Amazon showroom as a Zacks Rank #1 (Strong Buy). Best Buy (BBY) is just that thanks to a string of beats that dates back to March of 2013.

Revenues for BBY have slipped from the highs back in 2013, but they have seem to have found a bottom. That suggests that consumers will remain loyal to the store. Over the last year and a half the stock has actually trended higher.

Also at a Zacks Rank #1 (Strong Buy) is Aaron’s (AAN) which also has a Value Style Score of “A” as well as a Growth Style Score of “A.”

Estimates for AAN have been increasing. The company has seen estimates move from $2.29 to $2.41 over the last 90 days. The 2018 number has also moved higher, to $2.55 to $2.72 over the same time period.

AAN has also beat the Zacks Consensus Estimate in each of the last four quarters. The big idea is that the percentage of positive earnings surprise has been increasing. Four quarters ago the company posted a beat of 3.5%, then 6.4%. The new two quarters saw beats of 11% and then 21%. That is just what investors like to see.

Zacks Rank #2 (Buy)

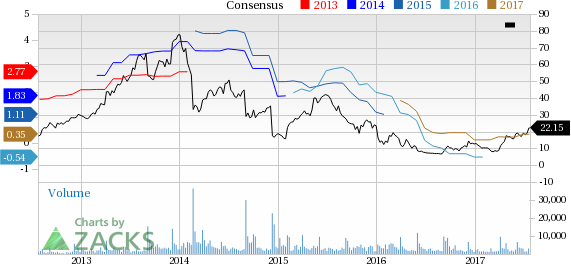

Conn’s (CONN) is a Zacks Rank #2 (Buy) and also sports growth and value style scores of “A.” Like AAN, this company has also posted four straight beats of the Zacks Consensus Estimate. The average positive earnings surprise over that time span has been 80% and that is a huge number.

Part of the reason for the big surprise is the fact that the company is seeing smaller than expected losses. Over the time period of the last four reports, the stock has more than doubled from below $10 to more than $22 today.

Conn's, Inc. (CONN): Free Stock Analysis Report

Best Buy Co., Inc. (NYSE:BBY): Free Stock Analysis Report

Amazon.com, Inc. (NASDAQ:AMZN): Free Stock Analysis Report

Aaron's, Inc. (AAN): Free Stock Analysis Report

Original post

Zacks Investment Research