Verint Systems (VRNT) is a Zacks Rank #3 (Hold) but the Zacks Rank for this stock could be moving higher following a big beat and raise that was just posted. The company reported earnings after the close on September 6, posting revenues of $278M when $270M were expected. EPS came in at $0.61 when Wall Street was looking for just $0.47 so the beat was $0.14 or a 29% positive earnings surprise.

The company also provided some guidance for the fiscal year 2018 (FY18). The company sees EPS of $2.75 compared to the Wall Street estimate for $2.72 and revenues are expected to be in line with the consensus estimate of $1.14B.

Profile Of VRNT

Yes, it was a good quarter with a slightly higher guide, but what is it exactly that the company does? Verint (VRNT) has over 10,000 customers in 180 countries and calls more than 80% of the Fortune 100 a client. It's Actionable Intelligence Platform has the capability to capture data, process it, analyze it and then engage and act. The company does this via two segments, the customer engagement segment, and the cyber intelligence segment.

The cyber intelligence segment is expected to grow revenue in the high single digits. The company has also noted that this revenue comes with a very high degree of retention (recurring revenues).

Right now, the margin profile for the intelligence segment is a drag on the over all margin profile for the company. With guidance telling us that earnings are expected to be higher on a consistent level of sales then margins must be improving in part of the company.

Zacks Rank #3 (Hold)

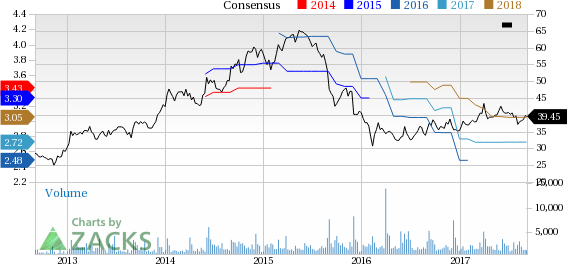

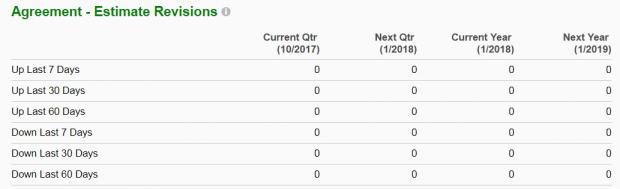

The stock is a Zacks Rank #3 (Hold) right now, but as the analysts tinker with their models, it is likely that we see earnings estimate revisions. If those revisions are positive, and they probably will be with the higher guidance, then we could see the Zacks Rank move higher for this stock.

The reason it is a Zacks Rank #3 (Hold) is due to the fact that there have been no earnings estimate revisions over the past 90 days.

Long Term View

As I think about this stock over the long term, I can only see growth ahead. The key will be to continuously improve margins. I see several big price targets from the covering analysts including a $48 target from RBC Capital Markets and a $47 target from Imperial. Of course, it doesn't hurt to be on the Goldman Sachs (NYSE:GS) conviction buy list, which VRNT became part of on August 7.

Free Tech Stock Newsletter

Let's face it, there is just too much data to keep track of. There are too many earnings reports and we all only have so much bandwidth to take it all in. Luckily, we have developed a tech stock newsletter that not only reviews the biggest ideas of the last week but also looks forward to the upcoming week as well. The best part about it is that it is totally free! I said FREE! To sign up, just click here: https://www.zacks.com/registration/newsletter/?type=TSN

Verint Systems Inc. (VRNT): Free Stock Analysis Report

Original post

Zacks Investment Research