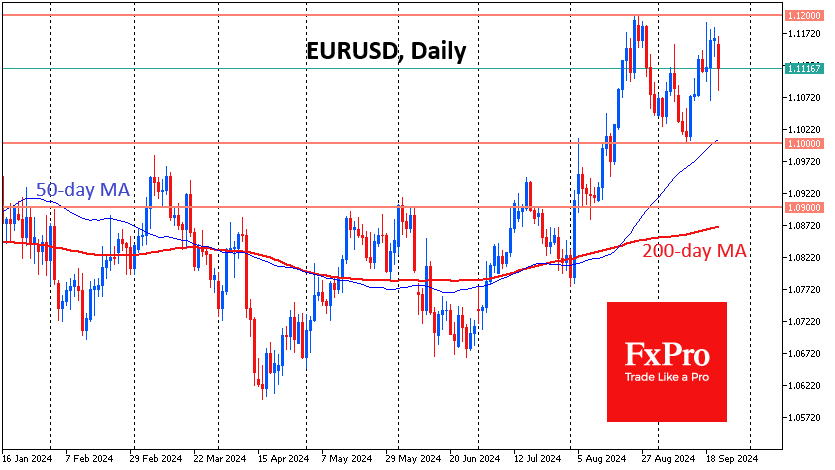

Flash Eurozone PMI estimates sent the EURUSD down 0.67% over the hour, as they were much weaker than expected and increased pressure on the ECB to continue easing monetary policy.

This is not the first time that a significant divergence of preliminary PMIs from expectations has become a driver of the European currency market. In terms of impact on the EURUSD, they rival the US employment data.

France's economic boom did not last long, as the composite PMI estimate for September fell to 47.4 from 53.1 the previous month and well below the expected 52.7. The manufacturing PMI has been hovering around 44 for the past three months and has only been above 50 once in the past two years. The services sector fell below the 50 mark to 48.3, its lowest level since March.

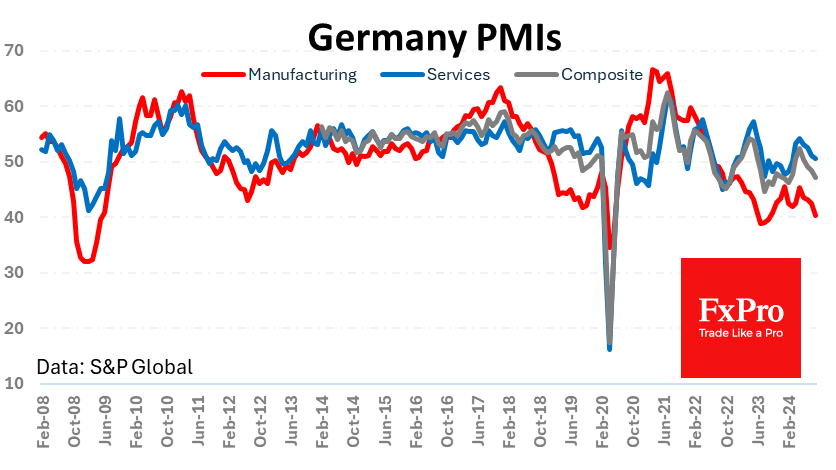

Estimates of business activity for September suggest that German manufacturing activity slowed at the fastest pace in 12 months, continuing its decline since May and falling to 40.3. The services sector also reversed the decline of four months ago, although it remains formally in expansion territory above 50.

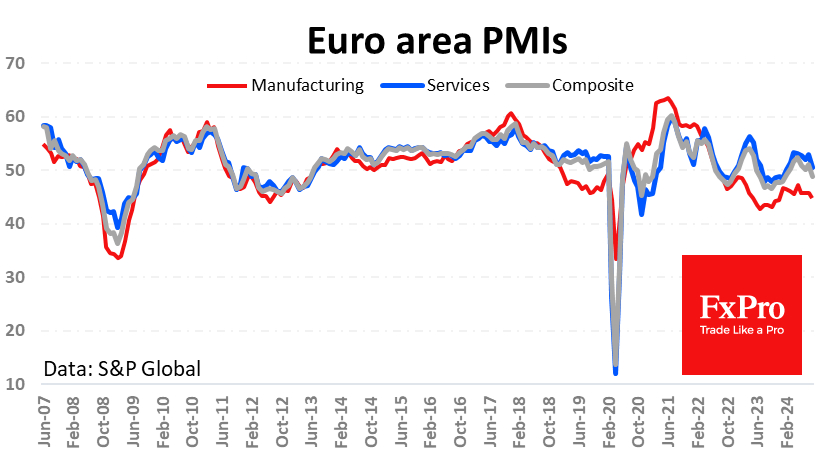

Manufacturing activity is contracting at the fastest pace since last December. At 50.5, the services sector is expanding at its slowest pace since February this year, but it's still growing.

The negative surprise in the data triggered a new downward momentum in the EURUSD and a temporary dip below 1.11. The pair has failed to consolidate above 1.12 for the past month, and the current decline, if sustained, would look like a double top formation with a potential near-term downside target of 1.10 and a more distant one of 1.09.

The obstacle to a longer-term weakening of the euro against the dollar is Fed policy. The FOMC cut rates by 0.5% last week, and current forecasts point to more active easing than the ECB.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What's Behind the Nosedive in Eurozone Economic Activity?

Published 09/23/2024, 09:54 AM

What's Behind the Nosedive in Eurozone Economic Activity?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.