Norwegian Oil and Gas Association (NOG) reported that its members comprising employers have entered into a new wage deal with oil-well service workers, ending the ongoing impasse. With the tussle over wages, the industry was risking a strike right when crude prices have started showing a recovery.

Wage Deal Saves Norwegian Oil Industry

The deal is important for crude, the dwindling fortunes of which had earlier cast a pall over Western Europe’s biggest oil-producing nation –– Norway. As per data compiled by the Norwegian Petroleum Directorate, the strike would have hurt the nation’s output by about 7%. Five fields operated by energy majors Exxon Mobil Corp. (NYSE:XOM) , Engie and BASF SE (DE:BASFN) would have been the most affected.

Our apprehension stems from the fact that Norway is a major player in the oil and gas global arena. According to the Energy Information Administration, which provides official energy statistics on behalf of the U.S. Government, Norway is Europe’s largest petroleum liquids producer, the world’s third-largest natural gas exporter, and an important supplier of both liquids and natural gas to other European countries. The Baltic nation is also the largest oil producer and exporter in Western Europe. The country is also has a favorable geographical position to fulfill European needs via its extensive export pipeline infrastructure, while the rest is exported as liquefied natural gas.

Backdrop

The energy space in the Baltic nation also witnessed stiff wage negotiations from unions in the recent past that hurt the stability of the industry. To blunt the impact of receding returns, major players in the Norwegian space are steadily shifting their focus to another relatively unexplored area in the Arctic – the Russian maritime borders. Licenses are about to be doled out for this area known as Barents Sea Southeast. Experts believe drilling could begin in the area as soon as in 2017.

To add to the woes of oil and gas majors having a substantial stake in Norway, the country is witnessing political pressure to force offshore producers to power offshore North Sea projects from clean sources in land. This is greatly contested by the energy majors’ lobby Norwegian Oil and Gas Association comprising prime foreign names like BP Plc (NYSE:BP) and Exxon Mobil which have a considerable stake in Norway. Our apprehension also rises from the fact that forcing offshore projects to procure power from land-based clean sources is bound to increase project costs.

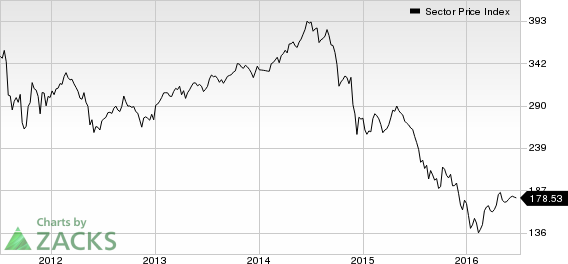

Finally, we feel that the stable functioning of the Norwegian oil and gas industry is vital to the U.S. given that the fate of crude is still hanging in a balance. After all, in 2008, West Texas Intermediate (WTI) crude futures hit a record high of more than $145 per barrel. Currently, however, WTI is hovering around only $47 per barrel. Investors interested in the broader energy sector can profit in the near term from Zacks wisdom and invest in Zacks Rank #1 (Strong Buy) stocks like World Fuel Services Corp. (NYSE:INT) and Tallgrass Energy GP, LP (NYSE:TEGP) .

WORLD FUEL SVCS (INT): Free Stock Analysis Report

BP PLC (BP): Free Stock Analysis Report

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

TALLGRASS ENRGY (TEGP): Free Stock Analysis Report

Original post

Zacks Investment Research