The dollar fell slightly against most of the G10 currencies during the European morning with EUR and CHF being the biggest winners. EUR/USD added to its morning gains after the much-better-than-expected Italian consumer confidence in September (101.1 vs 98.5 exp.), breaking once again above the 1.3500 level.

On the other hand, the NOK experienced the biggest losses of the morning after Norway’s unemployment rate increased in July to 3.6% from (a revised) 3.4%, missing the market’s forecast of 3.3%. USD/NOK and EUR/NOK had both been declining in the early European morning, but from around 1 ½ hours before the data release they both started rising and jumped further when the number came out.

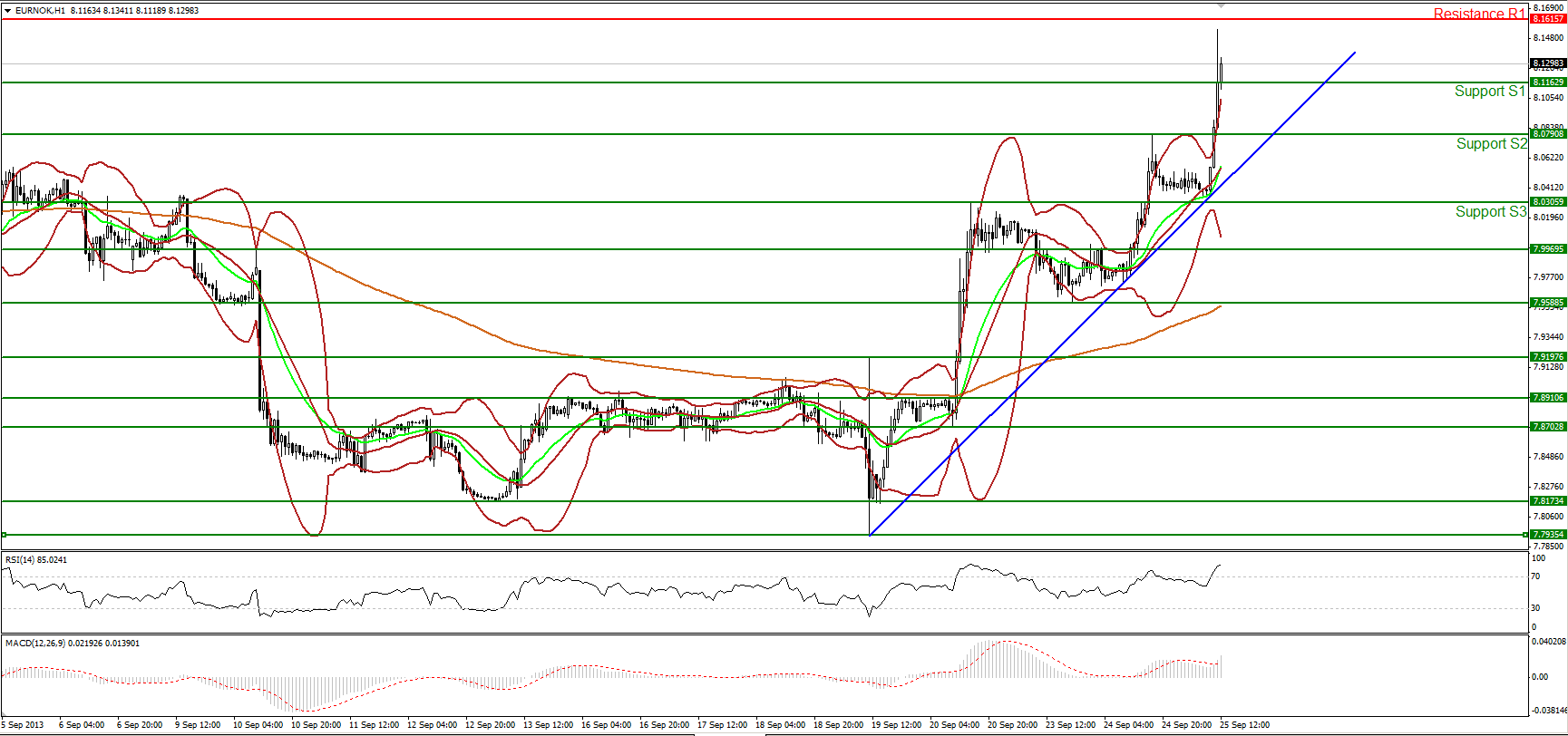

EUR/NOK extended its short-term highs after breaking two resistance barriers in a row (current support levels). During the early European afternoon, the pair is trading between the 8.1162 (S1) and the 8.1615 (R1) levels. A break above the latter should find the pair challenging territories that it last saw back in 2010. However, the rate has moved significantly away from the uptrend line, also above the upper Bollinger band, and alongside with RSI indicating overbought conditions, a pullback during the near future is possible. It is worth mentioning that on the daily chart, a long term uptrend remains in force since January 2013.

- Support levels are identified at 8.1162 (S1), followed by 8.0790 (S2) and 8.0305 (S3). The latter two are found from the weekly chart.

- Resistance is at 8.1615 (R1), followed by 8.2054 (R2) and 8.2532 (R3) respectively

EUR/NOK: One Hour" width="1729" height="812">

EUR/NOK: One Hour" width="1729" height="812">Disclaimer: This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients’ orders. This material is just the personal opinion of the author(s) and client’s investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained.

Past performance does not guarantee or predict any future performance. Redistribution of this material is strictly prohibited. Risk Warning: Forex and CFDs are leveraged products and involves a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. IronFx Financial Services Limited is authorised and regulated by CySEC (Licence no. 125/10). IronFX UK Limited is authorised and regulated by FCA (Registration no. 585561). IronFX (Australia) Pty Ltd is authorized and regulated by ASIC (AFSL no. 417482)