- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Northrop Grumman Wins $445M Air Force Deal To Support LAIRCM

Northrop Grumman Systems Corp.’s (NYSE:NOC) business unit, Northrop Grumman Systems Corp., recently secured a contract to support the AAQ-24 large aircraft infrared counter-measure (LAIRCM) direct sales public private partnership for repair of 34 national stock numbers. Work related to this deal is scheduled to be over by Dec 14, 2022 and will be executed in Warner Robins, GA.

Valued at $444.6 million, the contract was awarded by the Air Force Sustainment Center, Robins Air Force Base, GA. Foreign military funds (FMS) funds will be used to partly finance the task.

A Brief Note on LAIRCM

The primary purpose of Northrop Grumman’s LAIRCM program is to protect large aircraft from man-portable missiles. On identifying a missile, LAIRCM activates a high-intensity, laser-based countermeasure system to track and destroy the missile automatically.

Our View

Of late, terrorist groups have been increasingly using cheap yet deadly man-portable missiles. Thus, an effective anti-missile solution for the protection against such threats is the need of the hour. A well-equipped nation like the United States thus will always want to remain prepared for sudden attacks.

Moreover, over the past few months, repeated missile threats from North Korea have forced the United States to ramp up its focus toward its missile defense space. Undoubtedly, this has led the Trump administration to multiply its arsenal treasury, both in terms of attacking missiles as well as accumulating protective measures like LAIRCM.

Currently, Northrop Grumman’s AN/AAQ-24(V) Directional Infrared Countermeasure (DIRCM) system is the only DIRCM system in production that protects an aircraft from infrared-guided missiles. LAIRCM is one variant of such a DIRCM. Considering the present situation in the nation and Northrop Grumman’s combat-proven LAIRCM, more contracts like the recent one can be expected to boost Northrop’s sales.

Moreover, per Markets and Markets research firm, the global rocket and missile market is projected to grow at a CAGR of 4.74% during 2017-2022 to reach a value of $70 billion by 2022. This further reflects substantial growth prospects for defense majors like Northrop Grumman that offer counter-measures against missile threats.

Further, the Senate’s approval for the $700 billion National Defense Authorization Act this September indicates significant inflow of contracts for the front-row defense stocks in the United States. Therefore, the time is ripe for adding defense majors like Northrop Grumman, Lockheed Martin Corporation (NYSE:LMT) , Raytheon Company (NYSE:RTN) and The Boeing Company (NYSE:BA) , in your watchlist.

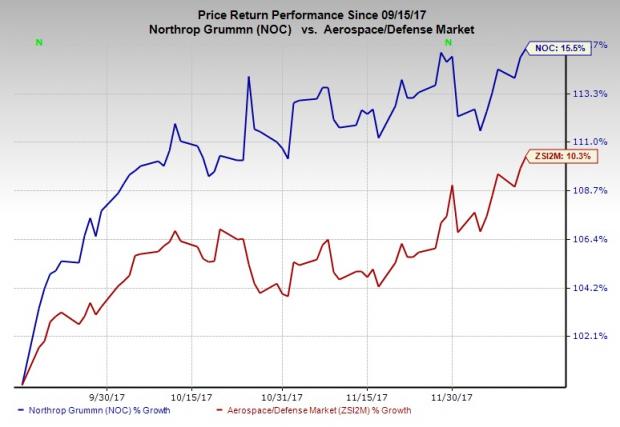

Price Performance

Northrop Grumman’s stock has returned 15.5% in last three months, outperforming the 10.3% rally of the industry it belongs to. This may have been driven bythe fact that the company’s product line is well positioned in high priority categories, such as defense electronics, unmanned aircraft and missile defense.

Zacks Rank

Northrop Grumman currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

Boeing Company (The) (BA): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.