Northrop Grumman Corporation (NYSE:NOC) reported fourth-quarter 2018 earnings of $4.93 per share, beating the Zacks Consensus Estimate of $4.45 by 10.8%. Reported earnings also surged 224% from $1.52 recorded in the year-ago quarter.

For 2018, earnings were $21.33 per share, up 52% from the year-ago quarter. Moreover, full-year earnings figure exceeded the Zacks Consensus Estimate of $19.08 by 11.8%.

The improvement in full year earnings was primarily a result of the addition of Innovation Systems in 2018 and the impacts related to the Tax Cuts and Jobs Act in 2017.

Total Revenues

In fourth-quarter 2018, Northrop Grumman reported total revenues of $8,156 million, beating the Zacks Consensus Estimate of $8,109 million by 0.58%. Revenues also increased 24.5% from the year-ago quarter’s $6,552 million. The revenue upside was primarily driven by 6% increase in Aerospace systems sales and 2% in Mission Systems sales.

In 2018, total revenues increased 15.7% year over year to $30,095 million. Full-year revenues surpassed the Zacks Consensus Estimate of $30,050

million by a mere 0.15%.

Segmental Details

Aerospace Systems: Segment sales of $3,197 million increased 6% year over year as a result of higher volumes of manned aircraft and space programs.

Operating income rose 12% to $337 million, whereas operating margin expanded 50 basis points (bps) to 10.5%.

Mission Systems: Segment sales increased 2% to $3,041 million, due to higher sales volume of Sensors and Processing systems.

Operating income rose 17% to $398 million, with operating margin expanding 170 bps to 13.1%.

Technology Services: Sales at this segment dropped 8% to $1,065 million, primarily due to the completion of several programs, including JRDC and KC-10.

Operating income increased 62% to $115 million, with operating margin expanding a massive 460 bps to 10.8%.

Innovation Systems

Innovation Systems’ fourth-quarter 2018 sales increased 7% compared with $1,400 million proforma sales in the fourth quarter of 2017. The sales increase was due to higher volume for Flight Systems and Defense Systems. The segments’ operating income totaled $143 million and operating margin rate was 9.8%.

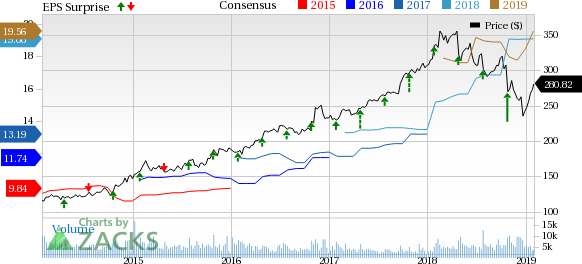

Northrop Grumman Corporation Price, Consensus and EPS Surprise

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY): Free Stock Analysis Report

Hexcel Corporation (HXL): Free Stock Analysis Report

Textron Inc. (TXT): Free Stock Analysis Report

Original post

Zacks Investment Research